This credential represents a formal acknowledgement of proficiency in office administration and management. It signifies that an individual possesses a standardized level of knowledge, skills, and experience in areas such as office operations, human resources, financial management, and technology. Earning this designation typically involves completing a qualifying educational program, meeting specific work experience requirements, and passing a comprehensive examination.

The value of achieving this professional recognition lies in its ability to enhance career prospects and demonstrate competence to employers. It often leads to increased earning potential, greater job security, and improved opportunities for advancement within an organization. Furthermore, holding this credential can instill confidence in clients and stakeholders, assuring them of the office manager’s dedication to maintaining high standards of professionalism and efficiency. Historically, the rise of this certification reflects a growing recognition of the critical role office managers play in ensuring the smooth functioning of businesses across various industries.

Understanding the pathways to acquiring this status, the specific competencies it validates, and the resources available for preparation are essential for individuals seeking to advance their careers in office management. Further discussion will delve into the examination process, the ongoing professional development requirements necessary to maintain the credential, and the impact this qualification has on overall organizational effectiveness.

1. Competency Validation

Competency validation, within the framework of certified office manager certification, serves as the cornerstone for ensuring that individuals possess the requisite skills, knowledge, and abilities to effectively perform their duties. This validation process substantiates an individual’s capabilities and confirms their alignment with industry-recognized standards of excellence.

-

Examination Rigor

Suggested read: How to Verify SOC 2 Certification: Everything You Need to Know Before Trusting a Vendor

The certification examination assesses a broad spectrum of competencies, ranging from financial management and human resources administration to technological proficiency and office operations. A stringent examination process guarantees that only those individuals demonstrating a comprehensive understanding of these critical areas achieve certification. This rigor assures employers that certified individuals possess a validated skillset directly applicable to their job responsibilities.

-

Experience Requirements

Practical experience is an indispensable component of competency validation. Certification programs typically mandate a minimum number of years of relevant work experience, ensuring that candidates have applied their theoretical knowledge in real-world scenarios. This experiential requirement bridges the gap between academic understanding and practical application, resulting in professionals who are not only knowledgeable but also capable of effectively addressing on-the-job challenges.

-

Continuing Education

Competency validation is not a static process; it requires ongoing commitment to professional development. Many certification programs mandate continuing education credits to ensure that certified office managers remain current with evolving industry trends, technological advancements, and best practices. This continuous learning component safeguards against obsolescence and reinforces the ongoing relevance of the certification.

-

Performance Standards

Certified office managers are held accountable to established performance standards that govern their professional conduct and ethical practices. These standards provide a framework for evaluating performance and ensuring adherence to industry best practices. By adhering to these standards, certified individuals demonstrate a commitment to excellence and maintain the integrity of the certification itself.

Suggested read: Peptide Therapy Certification: What Every Healthcare Professional Needs to Know in 2025

These interconnected facets of competency validation collectively underpin the credibility and value of the certified office manager certification. They provide employers with the assurance that certified individuals possess the validated skills and knowledge necessary to excel in their roles, contributing to increased operational efficiency and organizational success. The rigorous examination, practical experience requirements, continuing education mandates, and adherence to performance standards all work in concert to guarantee that certification represents a true measure of competency within the field of office management.

2. Career Advancement

Career advancement, in the context of the certified office manager certification, represents a tangible progression along a defined professional trajectory. This certification serves not merely as a static qualification, but as a catalyst for enhanced career opportunities and increased responsibilities within an organization.

-

Enhanced Earning Potential

Achieving the certification often correlates directly with increased earning potential. Employers frequently recognize the value of certified professionals through higher salaries and enhanced benefits packages. This financial incentive acknowledges the specialized knowledge and proven skills that certified office managers bring to the table. For instance, studies within the administrative services sector demonstrate a consistent trend of certified personnel commanding higher compensation than their non-certified counterparts, reflecting the competitive advantage conferred by the credential.

-

Increased Job Responsibilities

Certification frequently opens doors to roles with expanded job responsibilities. Certified office managers are often entrusted with managing larger teams, overseeing more complex projects, and contributing to strategic decision-making processes. This expansion of responsibilities signals a higher level of trust and confidence from organizational leadership, solidifying the individual’s position as a key contributor to the overall success of the business. Examples include transitioning from managing basic administrative tasks to overseeing departmental budgets and human resource functions.

-

Greater Marketability

Suggested read: SPAB Certification: Everything You Need to Know About School Pupil Activity Bus Certification in California

Possessing the certification significantly enhances an individual’s marketability in the competitive job market. Employers actively seek candidates who demonstrate a commitment to professional development and possess validated competencies. The certification serves as a readily recognizable indicator of these qualities, making certified individuals more attractive to potential employers. This increased marketability translates into a broader range of job opportunities and a greater ability to negotiate favorable employment terms. Job boards and recruitment agencies routinely highlight the certification as a desired qualification for office management positions.

-

Opportunities for Promotion

The credential frequently serves as a prerequisite or a significant advantage when seeking promotions within an organization. Demonstrating a commitment to professional development and possessing validated skills is often a key factor in promotion decisions. Certification provides a tangible demonstration of these qualities, increasing the likelihood of upward mobility within the company hierarchy. Individuals who invest in the process are often viewed as having a greater commitment to the profession and the organization. This dedication strengthens opportunities for future advancement.

These facets of career advancement are intrinsically linked to the certified office manager certification. The credential validates skills and knowledge, leading to increased earning potential, expanded job responsibilities, enhanced marketability, and greater opportunities for promotion. This certification serves as a strategic investment in an individual’s career, providing a pathway to greater success and professional fulfillment within the field of office management. The rigorous standards and ongoing requirements for maintaining the certification ensure its continued relevance and value in the evolving landscape of business administration.

3. Industry Recognition

The attainment of certified office manager certification significantly enhances industry recognition for professionals in this field. This recognition stems from the standardization and validation of skills and knowledge inherent within the certification process. Employers and industry stakeholders alike value the assurance that certified individuals possess a demonstrated level of competency, adhering to established best practices. This translates into increased credibility and trust within the workplace.

For example, consider a scenario where two candidates are vying for a senior office management position. One candidate possesses several years of experience but lacks formal certification, while the other holds the certified office manager credential. The certified candidate is likely to be favored, as the certification serves as concrete evidence of their capabilities, minimizing the perceived risk for the employer. Furthermore, industry associations often recognize and promote certified professionals, increasing their visibility within the sector. Conferences and workshops may offer specialized tracks or presentations specifically for certified individuals, further enhancing their reputation and access to networking opportunities.

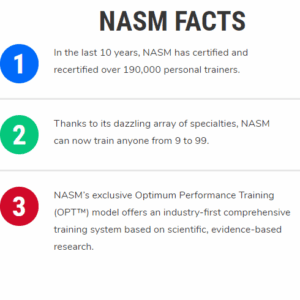

Suggested read: Is NASM Certification Worth It? An Honest Look at Costs, Benefits, and Career ROI

In conclusion, industry recognition is a pivotal component of certified office manager certification, creating a positive feedback loop where certification leads to increased recognition, which in turn enhances career prospects and professional standing. While challenges may persist in ensuring universal recognition across all sectors, the credential remains a valuable asset for those seeking to establish themselves as leaders and experts within the field of office management. This understanding is crucial for individuals pursuing certification and for organizations seeking to recruit and retain top talent in this critical role.

4. Standardized Knowledge

Standardized knowledge forms the bedrock of certified office manager certification. The certification process is designed to ensure that individuals possess a common, rigorously defined body of knowledge relevant to effective office management practices. This standardization addresses the variability in skills and understanding that can arise from diverse educational backgrounds and on-the-job training experiences. The emphasis on standardized knowledge is a direct response to the need for consistent quality and competence in office management across organizations.

The examination component of most certification programs serves as a primary means of assessing standardized knowledge. Questions are meticulously designed to test proficiency in areas such as financial administration, human resources management, technology utilization, and legal compliance. Successfully navigating this examination demonstrates that the individual possesses a minimum acceptable level of competence, regardless of their previous work experience. For instance, a certified office manager should understand Generally Accepted Accounting Principles (GAAP) to ensure accurate financial reporting, or be well-versed in employment law to mitigate potential legal risks within the workplace. The attainment of such knowledge is critical for any office manager to maintain effective organization-wide operational efficiency.

Without standardized knowledge, the value and credibility of the certification would be undermined. It is the foundation upon which employers can rely when seeking qualified professionals, knowing that certified individuals possess a certain baseline of skills and understanding. While practical experience is undoubtedly valuable, standardized knowledge ensures that this experience is grounded in established best practices and relevant principles. This combination of theory and practical application contributes significantly to the overall effectiveness and professionalism of certified office managers in various organizational settings.

5. Professional Development

Professional development is intrinsically linked to certified office manager certification, serving as both a precursor to achieving the credential and an ongoing requirement for maintaining its validity. The attainment of this certification necessitates a commitment to continuous learning and skill enhancement. Initial eligibility for the certification frequently mandates the completion of specific educational programs, workshops, or seminars relevant to office management. These initial professional development activities lay the foundation of knowledge and skills assessed during the certification examination. Without this foundational professional development, prospective candidates would likely lack the necessary competence to successfully complete the certification process. For example, a candidate might attend a workshop on project management software to gain the skills necessary to answer questions about project implementation on the certification exam.

Maintaining the certification typically involves accruing continuing education credits (CEUs) or participating in ongoing professional development activities. This requirement ensures that certified office managers remain abreast of evolving industry trends, technological advancements, and best practices. Professional development in this context prevents skill obsolescence and enhances the individual’s ability to adapt to changing workplace demands. Organizations such as the International Association of Administrative Professionals (IAAP) offer resources, training, and networking opportunities that facilitate ongoing professional development. For instance, participation in IAAP’s educational programs can provide the CEUs necessary to maintain certification, while also expanding the certified office manager’s professional network and knowledge base.

In conclusion, professional development is not merely an optional add-on to certified office manager certification but an essential and integrated component. It serves as both a springboard to achieving the credential and a mechanism for sustaining its value over time. The pursuit of continuous learning enhances the individual’s skills and knowledge, thereby contributing to increased effectiveness and professionalism within the workplace. By actively engaging in professional development activities, certified office managers demonstrate a commitment to excellence, contributing to the integrity and credibility of the certification itself.

Suggested read: A4M Peptide Certification: Everything Practitioners Need to Know Before Enrolling

Frequently Asked Questions About Certified Office Manager Certification

This section addresses common inquiries regarding the certified office manager credential. It seeks to provide clear and concise answers to assist individuals in understanding the purpose, requirements, and benefits of this professional qualification.

Question 1: What is the primary purpose of Certified Office Manager Certification?

The primary purpose is to establish a recognized standard of competence for office management professionals. It validates an individual’s knowledge, skills, and experience, ensuring they meet predetermined benchmarks of proficiency within the industry.

Question 2: What are the typical eligibility requirements for obtaining this certification?

Eligibility requirements generally encompass a combination of educational qualifications, relevant work experience in office administration or management, and the successful completion of a comprehensive examination. Specific requirements may vary depending on the certifying organization.

Suggested read: Why ISO 9000 Certification Consultants Are Essential for Business Growth

Question 3: What specific topics are typically covered in the certification examination?

The examination typically covers a broad range of topics essential to effective office management, including financial management, human resources administration, technology utilization, office operations, legal compliance, and communication skills. The weighting of each topic may vary.

Question 4: How does holding certified office manager certification benefit an individual’s career?

The certification can enhance career prospects by demonstrating competence to employers, increasing earning potential, improving job security, and creating opportunities for career advancement. It often leads to greater recognition and respect within the field.

Suggested read: ISO 27001 Certification Consultants: Your Strategic Partner for Information Security Excellence

Question 5: What are the ongoing requirements for maintaining certified office manager certification?

Maintaining the certification usually requires the completion of continuing education credits (CEUs) or participation in professional development activities. These requirements ensure that certified individuals remain current with evolving industry trends and best practices.

Question 6: Are there different levels or specializations within certified office manager certification?

Some certifying organizations may offer different levels or specializations within their certification programs, catering to specific areas of expertise within office management. These specializations can provide a more focused validation of skills in particular domains.

The key takeaway is that certified office manager certification offers a structured pathway to professional recognition and career advancement. It requires dedication and ongoing commitment to learning, but the benefits can be substantial.

Suggested read: CIT Certificate: Everything You Need to Know About Corporate Income Tax Certification in 2026

The subsequent section will explore resources available to assist individuals in preparing for certification and maintaining their credentials.

Tips for Obtaining and Maintaining Certified Office Manager Certification

This section offers practical guidance for individuals pursuing or maintaining certified office manager certification. Adhering to these recommendations can increase the likelihood of success and maximize the benefits derived from the credential.

Tip 1: Thoroughly Review Eligibility Requirements: Before initiating the certification process, meticulously examine the eligibility criteria established by the certifying organization. Ensure that educational qualifications, work experience, and any other prerequisites are fully met to avoid potential disqualification.

Tip 2: Develop a Comprehensive Study Plan: Allocate sufficient time for thorough preparation. Create a structured study schedule that covers all relevant topics outlined in the certification examination syllabus. Utilize a variety of study resources, including textbooks, online courses, and practice exams.

Tip 3: Focus on Key Competency Areas: Prioritize the core competency areas assessed in the certification examination. These typically include financial management, human resources administration, technology utilization, and office operations. Identify areas of weakness and dedicate extra time to improving proficiency in these domains.

Tip 4: Seek Mentorship and Guidance: Connect with experienced certified office managers who can provide valuable insights, advice, and support throughout the certification process. Consider joining professional organizations or networking groups to access mentorship opportunities.

Tip 5: Actively Participate in Professional Development: Continuously engage in professional development activities to expand knowledge and skills. Attend industry conferences, workshops, and seminars to stay abreast of evolving trends and best practices. Document all professional development activities to ensure compliance with continuing education requirements.

Suggested read: CPT Certification: What It Is & Why It Matters

Tip 6: Maintain Accurate Records: Maintain meticulous records of all educational qualifications, work experience, and professional development activities. These records may be required to verify eligibility for certification or to demonstrate compliance with continuing education requirements.

Tip 7: Practice Time Management: During the certification examination, effectively manage time to ensure that all questions are addressed. Practice answering questions under timed conditions to improve speed and accuracy.

These tips provide a strategic approach to obtaining and maintaining certified office manager certification. Diligence and a commitment to continuous learning are essential for success. The dedication towards mastering these points will lead to a high success rate in attaining the qualification.

The concluding section will summarize the benefits of the certification.

In Conclusion

The preceding analysis has demonstrated that certified office manager certification represents a significant professional credential. The examination of competency validation, career advancement, industry recognition, standardized knowledge, and professional development reveals a multifaceted value proposition. This certification is not merely a title, but a formal acknowledgement of expertise and a commitment to upholding industry standards.

The pursuit of certified office manager certification demands dedication and rigorous preparation. However, the rewards enhanced career prospects, increased earning potential, and improved professional standing justify the investment. Organizations benefit from employing certified professionals, as they bring validated skills and knowledge that contribute to increased operational efficiency and overall success. Therefore, individuals seeking to elevate their careers in office management and organizations striving for excellence should seriously consider the merits of this certification.