![Get Orthopedic Technologist Certification | [Year] 1 get orthopedic technologist certification year](https://shortcertificate.com/wp-content/uploads/2026/02/get-orthopedic-technologist-certification-year-1024x833.png)

The attainment of credentials in the field of orthopedic technology signifies a professional’s demonstrated competency in assisting orthopedic surgeons and other healthcare professionals in the care of patients with musculoskeletal conditions. This process often involves completing a formal education program, gaining practical experience, and passing a standardized examination.

Possession of these credentials validates a healthcare worker’s skills and knowledge, potentially leading to enhanced career opportunities and increased earning potential. Historically, standardized validation in this domain has been critical for ensuring consistent, high-quality patient care within orthopedic practices. It promotes a recognized standard of proficiency and contributes to the overall credibility of the profession.

The following sections will delve into the specific requirements for achieving these qualifications, the recognized certifying bodies, and the impact that achieving this validation has on career advancement and the broader healthcare landscape. The role of continuing education and maintaining active credentials will also be explored.

1. Eligibility Requirements

Eligibility requirements form the foundational gateway to attaining credentials as an orthopedic technologist. These prerequisites, established by certifying bodies, ensure that candidates possess the necessary foundational knowledge and practical experience before attempting to demonstrate competence through standardized assessments. A candidate’s adherence to these stipulations directly impacts their ability to pursue and successfully complete the certification process.

For example, many certifying organizations mandate completion of an accredited orthopedic technologist training program or a specific number of hours of supervised clinical experience. Failure to meet these criteria disqualifies an applicant, irrespective of their practical skills or perceived aptitude. These requirements serve as quality control measures, ensuring that certified professionals have undergone a minimum level of preparation, thus safeguarding patient safety and maintaining the integrity of the profession.

Suggested read: How to Verify SOC 2 Certification: Everything You Need to Know Before Trusting a Vendor

In summary, eligibility requirements are not merely procedural hurdles but crucial components of the certification process. They represent a commitment to standardized training and practical competence, ultimately contributing to the quality and credibility of certified orthopedic technologists within the healthcare system. Meeting the required conditions is the indispensable first step toward professional recognition in this specialized field.

2. Examination content

Examination content forms a pivotal component of the orthopedic technologist certification process, serving as a standardized method to assess a candidate’s knowledge and skills in the field. The content is designed to evaluate a technologist’s understanding of orthopedic principles, anatomy, physiology, biomechanics, and medical terminology, as well as practical skills in applying and removing casts, splints, and braces. The comprehensiveness and rigor of the examination directly impact the credibility and value associated with certification. Successfully navigating the examination demonstrates competence in the cognitive and psychomotor domains relevant to the profession.

For example, a typical certification examination may include sections on fracture management, surgical assisting, and patient education. Candidates might be required to identify anatomical structures on radiographs, demonstrate proper casting techniques, or explain post-operative care instructions to a simulated patient. The examination is not merely a test of memorization; it requires the application of knowledge to real-world clinical scenarios. A well-constructed examination ensures that certified technologists possess the necessary skills to contribute effectively to the orthopedic team and provide safe, high-quality patient care. The topics must be up-to-date and reflect current best practices in the field.

In essence, examination content acts as a gatekeeper, ensuring that only qualified individuals attain the “orthopedic technologist certification”. It provides a tangible measure of competence and contributes to the standardization of orthopedic care. Understanding the scope and depth of the examination content is essential for candidates seeking certification, as it guides their preparation and ensures they are equipped with the knowledge and skills necessary to succeed in this demanding healthcare role. Challenges lie in constantly updating the content to reflect the evolution of orthopedic technology and care protocols.

3. Clinical Proficiency

Clinical proficiency is a cornerstone requirement for orthopedic technologist certification. It represents the demonstrable ability to apply learned knowledge and skills effectively in real-world patient care scenarios. Certifying bodies prioritize clinical competence because it directly impacts patient outcomes and safety. Without proven aptitude in practical application, theoretical knowledge remains insufficient for competent orthopedic care. Certification programs typically integrate supervised clinical experiences, allowing candidates to hone their skills under the guidance of experienced professionals. The successful completion of these clinical rotations is often a prerequisite for eligibility to sit for the certification examination.

Deficiencies in clinical proficiency can manifest in various ways, such as improper application of casts leading to complications, incorrect use of orthopedic equipment resulting in patient discomfort or injury, or misinterpretation of physician orders causing errors in treatment. For instance, an orthopedic technologist lacking sufficient clinical expertise might apply a cast too tightly, potentially compromising circulation and causing nerve damage. Conversely, a technologist with strong clinical skills will be able to assess patient comfort, recognize potential problems, and adjust the cast accordingly to ensure optimal healing and prevent complications. This is also applicable to assisting in surgery, handling of equipment, and following hygiene and sterilization standards.

In conclusion, clinical proficiency is not merely a supplementary element but an indispensable component of orthopedic technologist certification. It ensures that certified professionals possess the practical skills and judgment necessary to provide safe and effective care to patients with musculoskeletal conditions. The emphasis on clinical expertise within the certification process reflects the profession’s commitment to upholding high standards of patient care and maintaining the credibility of certified orthopedic technologists. Continuous assessment and skill development, even after certification, are essential for sustained clinical proficiency.

Suggested read: Peptide Therapy Certification: What Every Healthcare Professional Needs to Know in 2025

4. Continuing Education

Continuing education is an integral component of maintaining orthopedic technologist certification, ensuring professionals remain current with evolving practices and advancements in the field. Recertification processes commonly mandate the completion of specific continuing education requirements.

-

Knowledge Enhancement

Continuing education provides a structured framework for orthopedic technologists to update their understanding of emerging technologies, surgical techniques, and treatment protocols. For instance, a technologist might participate in a workshop on new casting materials or attend a seminar on advances in arthroscopic procedures. Maintaining current knowledge enhances the quality of patient care and minimizes the risk of errors stemming from outdated practices.

-

Skill Refinement

Continuing education opportunities allow technologists to refine existing skills and acquire new competencies. This may involve hands-on training in advanced casting methods, instruction on the proper use of specialized orthopedic equipment, or education on effective communication strategies for patient education. Skill refinement translates directly into improved performance and efficiency in the clinical setting.

-

Compliance and Regulatory Updates

Suggested read: SPAB Certification: Everything You Need to Know About School Pupil Activity Bus Certification in California

The healthcare landscape is subject to ongoing regulatory changes and evolving standards of care. Continuing education ensures that orthopedic technologists remain informed about relevant compliance requirements, ethical considerations, and legal obligations. For example, coursework may cover HIPAA regulations, infection control protocols, or patient safety initiatives. Remaining compliant with regulations mitigates legal risks and fosters a culture of responsible practice.

-

Professional Development

Continuing education fosters professional development by encouraging orthopedic technologists to expand their knowledge base, improve their skills, and stay engaged with the orthopedic community. Attending conferences, participating in online courses, and engaging in peer-to-peer learning opportunities contribute to a sense of professional growth and fulfillment. Such experiences can also lead to career advancement and leadership opportunities within the orthopedic field.

In summary, continuing education is not merely a requirement for maintaining orthopedic technologist certification; it represents a commitment to lifelong learning and professional excellence. By actively engaging in continuing education activities, certified technologists ensure they are equipped with the knowledge, skills, and awareness necessary to provide the highest quality of care to their patients, contributing to the overall advancement of the orthopedic profession.

5. Renewal process

The renewal process is a critical and recurring component intrinsically linked to maintaining orthopedic technologist certification. It serves as the mechanism by which certifying bodies ensure that credentialed professionals maintain a consistent level of competence and remain abreast of advancements within the orthopedic field. The expiration of a certification necessitates the completion of specified requirements to reinstate active status, thus preventing individuals with potentially outdated skills or knowledge from continuing to practice under the auspices of a valid certification.

The specific requirements for renewal often include accumulating continuing education credits through approved courses, conferences, or workshops. Certifying bodies may also mandate periodic re-examination or demonstration of ongoing clinical practice. For instance, an orthopedic technologist might be required to complete a certain number of hours of continuing education related to new casting techniques or advances in surgical procedures every two years. Failure to meet these requirements results in a lapse in certification, potentially impacting employment opportunities and professional credibility. Some facilities may not allow technologists to practice without current credentials, underscoring the practical significance of adhering to the renewal process.

In summary, the renewal process for orthopedic technologist certification is not merely an administrative formality but a vital safeguard for ensuring continued competence and promoting high standards of patient care. It underscores the profession’s commitment to lifelong learning and adaptation to evolving clinical practices. Adherence to the renewal process maintains the integrity of the certification and ensures that certified technologists are qualified to provide safe and effective orthopedic care.

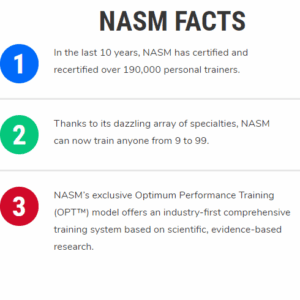

Suggested read: Is NASM Certification Worth It? An Honest Look at Costs, Benefits, and Career ROI

6. Professional Standards

Professional standards are intrinsically linked to orthopedic technologist certification, establishing the framework for ethical conduct, competence, and accountability within the profession. These standards provide a benchmark against which the performance and behavior of certified technologists are measured, ensuring consistent and high-quality patient care.

-

Scope of Practice

Professional standards clearly define the scope of practice for certified orthopedic technologists, delineating the specific tasks and procedures they are qualified to perform. This prevents overstepping boundaries and ensures that technologists operate within their area of expertise, safeguarding patient safety. For example, standards might specify that a certified technologist can apply casts and splints but not perform surgical procedures or prescribe medications. Adhering to the defined scope of practice minimizes the risk of errors and promotes appropriate collaboration with other healthcare professionals.

-

Ethical Conduct

Ethical standards guide the behavior of certified orthopedic technologists, promoting integrity, respect, and compassion in patient interactions. These standards address issues such as patient confidentiality, informed consent, and conflicts of interest. For instance, a technologist is expected to maintain patient privacy, provide clear and accurate information about treatment options, and avoid exploiting the therapeutic relationship for personal gain. Upholding ethical standards fosters trust and strengthens the patient-provider relationship.

-

Competency and Continuing Education

Suggested read: A4M Peptide Certification: Everything Practitioners Need to Know Before Enrolling

Professional standards emphasize the importance of maintaining competency through ongoing education and skill development. Certified technologists are expected to stay abreast of advancements in orthopedic technology and treatment protocols. This may involve attending conferences, completing continuing education courses, or participating in professional development activities. Demonstrating a commitment to lifelong learning ensures that technologists provide current and evidence-based care.

-

Accountability and Responsibility

Professional standards hold certified orthopedic technologists accountable for their actions and decisions. This includes taking responsibility for errors, adhering to safety protocols, and maintaining accurate documentation. For example, a technologist who makes a mistake in applying a cast is expected to acknowledge the error, take steps to correct it, and implement measures to prevent similar incidents in the future. Embracing accountability fosters a culture of transparency and continuous improvement within the orthopedic profession.

In conclusion, professional standards are not merely aspirational ideals but foundational principles that guide the practice of certified orthopedic technologists. By adhering to these standards, technologists demonstrate a commitment to ethical conduct, competence, and accountability, ultimately contributing to the delivery of safe, effective, and compassionate patient care. Continuous evaluation and enforcement of these standards are essential for maintaining the integrity and credibility of the “orthopedic technologist certification.”

Frequently Asked Questions About Orthopedic Technologist Certification

This section addresses common inquiries regarding the attainment and maintenance of credentials in orthopedic technology. The information provided aims to clarify misconceptions and provide a comprehensive understanding of the certification process.

Question 1: What are the fundamental prerequisites for initiating the certification process?

Typically, eligibility requires graduation from an accredited orthopedic technologist program or documented equivalent clinical experience under the supervision of a qualified orthopedic professional. Specific requirements vary between certifying organizations.

Suggested read: Why ISO 9000 Certification Consultants Are Essential for Business Growth

Question 2: What are the key topics covered in a standard certification examination?

The examination generally assesses knowledge in areas such as musculoskeletal anatomy, fracture management, casting and splinting techniques, surgical assisting, and orthopedic equipment usage.

Question 3: How does clinical experience factor into achieving certification?

A significant amount of supervised clinical practice is crucial. This experience allows candidates to apply theoretical knowledge in real-world scenarios, demonstrating competence in patient care.

Question 4: What mechanisms are in place to ensure certified technologists remain current in their field?

Most certifying bodies mandate ongoing continuing education to maintain certification. This ensures that certified professionals are aware of the latest advancements and best practices in orthopedic technology.

Suggested read: ISO 27001 Certification Consultants: Your Strategic Partner for Information Security Excellence

Question 5: What are the potential ramifications of allowing certification to lapse?

A lapse in certification can impact employment opportunities, professional credibility, and the ability to perform certain tasks within a healthcare setting. Reinstatement typically requires fulfilling specific requirements, such as completing additional continuing education or re-examination.

Question 6: How do professional standards govern the conduct of certified orthopedic technologists?

Professional standards outline expectations for ethical behavior, competence, and accountability. These standards guide decision-making and ensure the delivery of safe and effective patient care.

In summary, achieving and maintaining credentials in orthopedic technology requires rigorous preparation, ongoing professional development, and adherence to established standards. The certification process ensures that certified professionals are qualified to provide high-quality care to patients with musculoskeletal conditions.

The subsequent section will delve into the career prospects and potential advancements associated with achieving credentials as an orthopedic technologist.

Tips Regarding Orthopedic Technologist Certification

The following guidelines aim to assist individuals pursuing or maintaining credentials in orthopedic technology. Adherence to these recommendations can enhance the likelihood of successful certification and continued professional development.

Suggested read: CIT Certificate: Everything You Need to Know About Corporate Income Tax Certification in 2026

Tip 1: Prioritize Accredited Programs: Seek out and complete educational programs that are accredited by recognized bodies. Accreditation signifies that the program meets established standards for curriculum, faculty qualifications, and clinical training, enhancing the credibility of the acquired education.

Tip 2: Emphasize Clinical Proficiency: Actively engage in supervised clinical experiences. Seek opportunities to apply theoretical knowledge in real-world patient care scenarios. Proficient clinical skills are essential for both the certification examination and competent practice.

Tip 3: Understand Examination Content: Thoroughly review the content outline provided by the certifying organization. Focus study efforts on key areas such as musculoskeletal anatomy, fracture management, casting techniques, and surgical assisting. Familiarization minimizes surprises during the examination.

Tip 4: Utilize Practice Examinations: Take advantage of available practice examinations or sample questions. This allows for self-assessment of strengths and weaknesses, guiding further study efforts. Simulated testing conditions can reduce anxiety during the actual examination.

Tip 5: Maintain Continuing Education: Actively participate in continuing education activities to remain current with advancements in orthopedic technology. Select courses or workshops that address emerging technologies, treatment protocols, and best practices. This is crucial for maintaining certification and providing optimal patient care.

Tip 6: Adhere to Ethical Standards: Uphold the highest ethical standards in all professional interactions. Maintain patient confidentiality, provide honest and accurate information, and avoid conflicts of interest. Ethical conduct is a cornerstone of responsible practice.

Suggested read: CPT Certification: What It Is & Why It Matters

Tip 7: Document Clinical Hours: Meticulously document all supervised clinical hours. Accurate records are essential for demonstrating eligibility for certification and for tracking professional experience over time. Ensure that documentation meets the requirements of the certifying body.

Tip 8: Plan for Renewal: Be proactive in planning for certification renewal. Track continuing education credits and submit renewal applications well in advance of the expiration date. Avoidance of a lapse in certification is crucial for maintaining professional standing.

Implementing these recommendations contributes to a strong foundation for achieving and maintaining orthopedic technologist credentials, ultimately leading to enhanced career prospects and the delivery of superior patient care.

The following section provides a comprehensive summary, consolidating key insights and information regarding the process, requirements, and benefits.

Conclusion

The preceding sections have provided a comprehensive overview of orthopedic technologist certification. This process encompasses specific eligibility criteria, standardized examinations, supervised clinical experience, ongoing continuing education, and adherence to professional standards. Meeting these rigorous requirements signifies a professional’s validated competence in assisting orthopedic surgeons and other healthcare professionals in the management of musculoskeletal conditions. Maintenance of this certification necessitates active participation in continuing education and adherence to established ethical guidelines, ensuring the continued provision of high-quality patient care.

The pursuit and maintenance of orthopedic technologist certification represent a commitment to professional excellence and patient safety. Individuals considering this career path should carefully evaluate the requirements established by recognized certifying bodies and proactively engage in ongoing professional development. The attainment of this certification not only enhances individual career prospects but also contributes to the overall advancement and credibility of the orthopedic technology profession within the broader healthcare landscape.