This document, issued by the state, allows businesses to purchase goods intended for resale without paying sales tax. For example, a clothing boutique can acquire inventory from wholesalers by presenting this certificate, thus deferring the sales tax obligation until the clothing is sold to consumers.

Possessing this credential streamlines operations for retailers and other resellers by reducing upfront costs. It allows them to maintain healthy cash flow and invest in growth. Historically, such certificates were implemented to avoid double taxation on goods as they move through the supply chain.

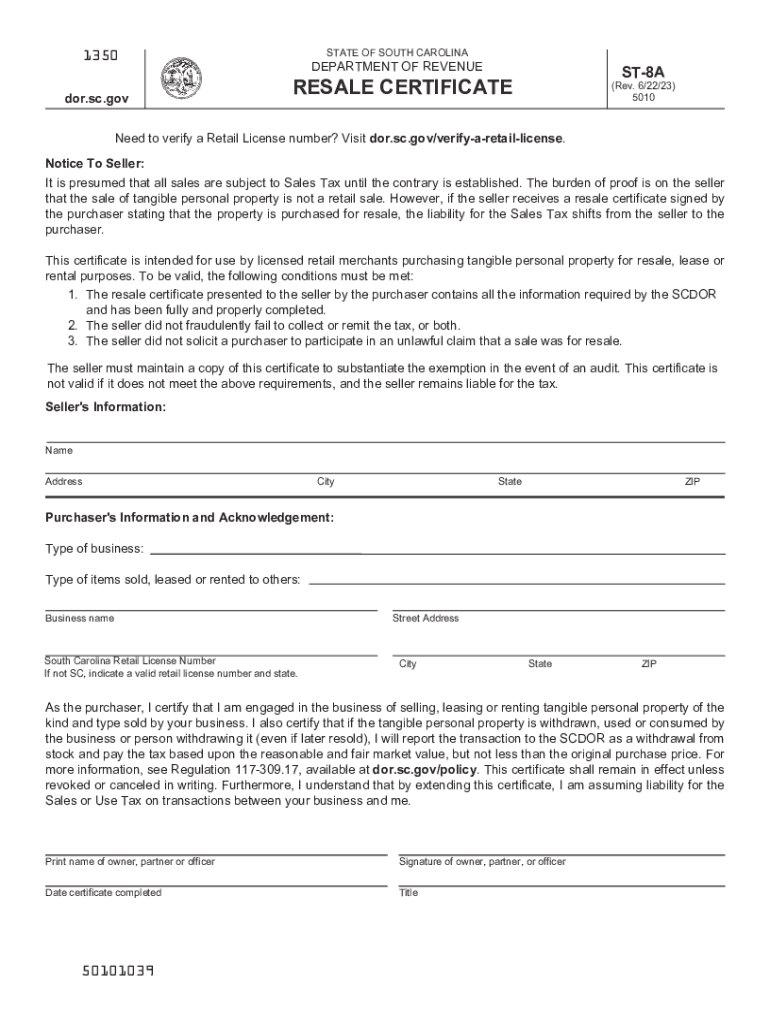

The subsequent sections will delve into the application process, permissible uses, and potential liabilities associated with the use of this particular document in South Carolina.

1. Tax-exempt purchases

Tax-exempt purchases are intrinsically linked to this certificate, representing the primary benefit and intended purpose for qualified businesses. This exemption allows eligible entities to acquire goods for resale without incurring sales tax at the point of purchase, provided specific conditions are met and the certificate is properly utilized.

-

Direct Resale Requirement

Suggested read: Get Your Louisiana Resale Certificate Fast & Easy

Goods acquired under the auspices of this document must be directly intended for resale to the end consumer. This implies a clear and demonstrable link between the purchased items and the business’s core resale activity. For example, a furniture store using the certificate to purchase sofas for its showroom qualifies, while using it to buy office supplies does not.

-

Exemption Scope Limitations

The tax exemption only applies to the tangible personal property purchased for resale. It does not extend to services, or items used or consumed by the business itself. A restaurant cannot use this certificate to purchase food ingredients for use in preparing meals, as the food is being consumed in the process, but can use it to purchase packaged snacks for resale.

-

Vendor Acceptance Obligations

Vendors are not obligated to accept this document. However, if they do, they must retain a copy as proof of the tax-exempt sale. Vendors who improperly accept the certificate may be held liable for the uncollected sales tax. It is the vendor’s responsibility to ensure the certificate is valid and presented by an authorized representative of the purchasing business.

-

Potential Audit Scrutiny

Tax-exempt purchases are often subject to increased scrutiny during state tax audits. Businesses must maintain meticulous records of all purchases made using this certificate, including invoices, purchase orders, and a copy of the valid certificate itself. The absence of adequate documentation can result in the disallowance of the exemption and the imposition of penalties.

Suggested read: IN Resale Certificate: Easy Guide + Apply Now!

These facets collectively illustrate the interplay between tax-exempt purchases and the function of the South Carolina resale certificate. Understanding and adhering to these stipulations is critical for businesses seeking to legitimately leverage the tax benefits afforded by the certificate and avoid potential legal and financial repercussions.

2. Application Process

Obtaining the relevant certification in South Carolina necessitates a structured application process. The successful procurement of this document is contingent upon accurately completing and submitting the required forms to the South Carolina Department of Revenue. This process acts as a gateway, determining which businesses can legally make tax-exempt purchases of goods intended for resale. Errors or omissions in the application can lead to delays or outright rejection, directly impacting a business’s ability to operate efficiently and competitively. For instance, a new retail business intending to purchase inventory from wholesalers must first navigate this process. Without a valid document obtained through the application, the business faces paying sales tax on its inventory, increasing its upfront costs and potentially hindering its ability to offer competitive pricing.

The application typically requires detailed information about the business, including its legal structure, registered address, and nature of business activities. Furthermore, the applicant must demonstrate a clear intent to engage in resale activities and may be required to provide supporting documentation, such as a business plan or supplier agreements. The South Carolina Department of Revenue meticulously reviews each application to ensure compliance with state regulations, verifying the legitimacy of the business and its intended use of the certification. This scrutiny ensures that the certificate is used appropriately and prevents its misuse for personal purchases or other unauthorized activities. For example, an applicant might need to provide details of their online store or physical retail location to prove that they are actually selling goods to customers.

In summary, the application process is a critical and indispensable step in obtaining the certificate in South Carolina. Its proper execution directly influences a business’s ability to operate legally and efficiently, impacting its financial performance and competitive standing within the market. Successfully navigating this process requires attention to detail, a clear understanding of state regulations, and a commitment to providing accurate and complete information to the South Carolina Department of Revenue.

3. Permitted usage

The scope of permitted usage dictates the legitimate application of the South Carolina resale certificate, defining the boundaries within which businesses can avail themselves of tax-exempt purchasing privileges. Adherence to these usage guidelines is crucial for maintaining compliance with state regulations and avoiding potential penalties.

-

Goods for Direct Resale

The primary and most permissible usage is the acquisition of tangible personal property solely intended for direct resale to the end consumer. This excludes items used in business operations, consumed during the service process, or otherwise not directly transferred to a customer. For example, a bookstore can utilize the certificate to purchase books for its inventory, but not to purchase cleaning supplies for the store itself.

Suggested read: Get Your Florida Resale Certificate Fast!

-

Component Parts and Materials

In certain manufacturing or assembly contexts, the certificate can extend to component parts or materials that become integral components of a finished product intended for resale. The purchased materials must undergo a significant transformation during the manufacturing process. A furniture manufacturer could, for instance, use the certificate to acquire lumber that will be transformed into finished furniture sold to consumers.

-

Sales Tax Collection Responsibility

Businesses using this certificate bear the responsibility for collecting and remitting sales tax on the final sale of the goods to the consumer. The certificate merely defers the sales tax obligation; it does not eliminate it. Failure to properly collect and remit sales tax constitutes a violation of state law and can lead to audits and penalties.

-

Prohibited Uses and Penalties

The certificate cannot be used for personal purchases, for acquiring goods for internal business use, or for any purpose other than direct resale or incorporation into a product for resale. Misuse of the certificate carries significant penalties, including the assessment of back taxes, interest, and fines. Repeated or egregious misuse can lead to the revocation of the certificate and potential legal action.

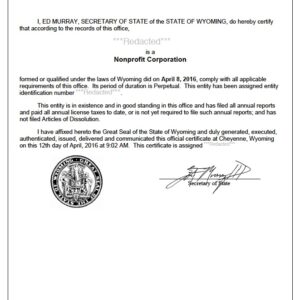

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

The permitted usage parameters surrounding the South Carolina resale certificate are explicitly designed to prevent tax avoidance and ensure fair competition. By understanding and adhering to these guidelines, businesses can leverage the legitimate benefits of the certificate while mitigating the risks associated with non-compliance.

4. Record-keeping requirements

Meticulous record-keeping is an indispensable component of maintaining compliance when utilizing a South Carolina resale certificate. The state mandates that businesses accurately document all transactions made under the auspices of this certificate. This requirement stems from the need to verify that tax-exempt purchases are exclusively for goods intended for resale, thereby preventing tax evasion. For instance, a retail store using the certificate to buy inventory must retain invoices, purchase orders, and other relevant documentation proving the goods were indeed purchased for resale and not for internal consumption. Failure to maintain adequate records can result in penalties, interest charges, and the potential revocation of the certificate itself.

Specifically, businesses are generally expected to retain records that detail the vendor’s name and address, the date of purchase, a description of the goods acquired, the purchase price, and a copy of the resale certificate provided to the vendor. These records serve as evidence during audits conducted by the South Carolina Department of Revenue. Consider a scenario where a business claims a large number of tax-exempt purchases but cannot produce the supporting documentation. In such instances, the state may disallow the exemption, assessing sales tax on the undocumented purchases and imposing penalties for non-compliance. This highlights the practical significance of diligent record-keeping in managing tax obligations effectively.

In conclusion, the record-keeping requirements associated with the South Carolina resale certificate are not merely administrative burdens but rather essential safeguards that ensure the integrity of the state’s tax system. Adhering to these requirements allows businesses to legitimately benefit from the tax exemption while minimizing the risk of adverse consequences. Understanding and implementing robust record-keeping practices is therefore paramount for any business operating under this certificate.

5. Potential liabilities

The improper use of a South Carolina resale certificate can trigger significant liabilities for businesses. These liabilities arise primarily from failing to adhere to the regulations governing the certificate’s use, effectively transforming a potential tax benefit into a financial burden. One major cause is the purchase of items not intended for resale, such as office supplies or personal goods, under the guise of the certificate. This constitutes a misrepresentation to the vendor and the state, leading to assessments for unpaid sales tax, penalties, and interest. For example, a construction company improperly using the certificate to buy tools would be liable for the sales tax they avoided, plus additional penalties.

The accurate collection and remittance of sales tax on the final sale to the end consumer is also critically important. The certificate merely defers the tax obligation; it does not eliminate it. Businesses failing to collect and remit sales tax are subject to audit and assessment for the uncollected taxes, coupled with potential penalties. A retailer who neglects to charge sales tax on items sold to customers, believing the certificate grants complete exemption, exposes the business to substantial liability. Furthermore, vendors who knowingly accept invalid or misused certificates can also be held responsible for the unpaid sales tax, highlighting the shared responsibility in ensuring compliance. Maintaining thorough records is crucial to demonstrate proper usage during audits, preventing or mitigating potential liabilities.

In summary, the potential liabilities associated with this document are a direct consequence of non-compliance with established regulations. These liabilities can manifest as unpaid taxes, penalties, interest charges, and even legal action. A clear understanding of permitted uses, diligent record-keeping, and proper sales tax collection practices are essential strategies for businesses to mitigate these risks and ensure they remain compliant with South Carolina tax laws. Ignoring these factors can transform a valuable tax benefit into a costly and potentially devastating financial burden.

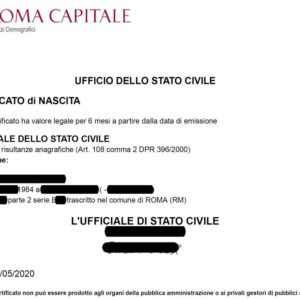

Suggested read: Email for Italian Birth Certificate? Get it Now!

Frequently Asked Questions

This section addresses common inquiries regarding the South Carolina resale certificate, providing clarification on its usage, application, and associated responsibilities.

Question 1: What constitutes acceptable proof of a valid South Carolina resale certificate for vendors?

Acceptable proof includes a physical copy of the certificate, a digital image of the certificate, or verification through the South Carolina Department of Revenue’s online system. Vendors should ensure the certificate is not expired and matches the purchaser’s business information.

Question 2: Can a business use a resale certificate from another state in South Carolina?

Generally, no. South Carolina typically requires a South Carolina-issued resale certificate for tax-exempt purchases within the state. Some reciprocal agreements may exist, but verification with the Department of Revenue is advised.

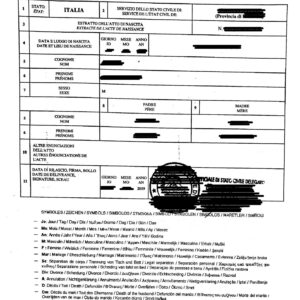

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

Question 3: What are the consequences of purchasing items for personal use with a South Carolina resale certificate?

Purchasing items for personal use is a violation of state tax law. The business is liable for the sales tax that was not paid, plus penalties and interest. Repeated misuse can lead to revocation of the certificate and further legal action.

Question 4: How often does the South Carolina resale certificate need to be renewed?

The South Carolina resale certificate does not require annual renewal. It remains valid as long as the business continues to meet the eligibility requirements and complies with state tax laws. However, changes to the business, such as a change of address, may require updating information with the Department of Revenue.

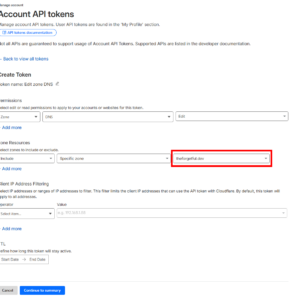

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

Question 5: Is it permissible to use this document to purchase services tax-exempt?

No. The South Carolina resale certificate is exclusively for the purchase of tangible personal property intended for resale. It does not apply to services.

Question 6: What steps should a business take if its South Carolina resale certificate is lost or stolen?

The business should immediately notify the South Carolina Department of Revenue. A replacement certificate may be issued upon request and verification of the business’s eligibility. Failing to report a lost or stolen certificate could expose the business to potential misuse and associated liabilities.

Understanding the nuances of the certificate and its proper application is paramount to navigating South Carolina’s tax regulations effectively.

Suggested read: Free Volunteer Certificate: Get Yours Now!

The following section will delve into strategies for mitigating the risks associated with improper certificate usage.

Tips for Utilizing a South Carolina Resale Certificate

This section presents essential guidelines for businesses operating with a South Carolina resale certificate, ensuring adherence to state regulations and minimizing potential liabilities.

Tip 1: Verify Vendor Acceptance. Confirm that the vendor accepts the South Carolina resale certificate before initiating a tax-exempt purchase. Not all vendors are obligated to honor the certificate, and assuming acceptance can lead to unexpected tax liabilities.

Tip 2: Maintain Detailed Records. Keep meticulous records of all transactions made using the certificate. These records should include invoices, purchase orders, and a copy of the certificate itself. Detailed documentation is crucial for demonstrating compliance during audits.

Tip 3: Restrict Purchases to Items for Resale. Use the certificate exclusively for acquiring tangible personal property intended for direct resale to customers. Avoid purchasing items for internal use or personal consumption, as this constitutes misuse and can trigger penalties.

Tip 4: Collect and Remit Sales Tax. Understand that the certificate only defers the sales tax obligation. Businesses are responsible for collecting and remitting sales tax on the final sale of the goods to the consumer. Failure to do so results in significant liabilities.

Tip 5: Train Employees on Proper Usage. Provide comprehensive training to employees responsible for purchasing and accounting on the permissible uses of the certificate. Ensuring employees understand the regulations minimizes the risk of inadvertent misuse.

Suggested read: Last Minute Valentines Gift Certificate - Now!

Tip 6: Stay Updated on Tax Law Changes. Regularly monitor updates to South Carolina tax laws and regulations pertaining to the resale certificate. Compliance requires staying informed of any changes that may affect eligibility or permitted usage.

Tip 7: Conduct Periodic Internal Audits. Perform periodic internal audits of resale certificate usage to identify and correct any instances of non-compliance. Proactive monitoring can help prevent larger issues from arising during state audits.

Adhering to these tips ensures that the South Carolina resale certificate is utilized responsibly and in accordance with state regulations, safeguarding businesses from potential legal and financial repercussions.

The concluding section will summarize the key aspects of the South Carolina resale certificate and offer final thoughts on its importance for businesses.

South Carolina Resale Certificate

This exploration has underscored the vital role the South Carolina resale certificate plays in the state’s business landscape. Its proper utilization allows eligible businesses to operate more efficiently by deferring sales tax on goods intended for resale. However, the document’s benefits are inextricably linked to a comprehensive understanding of and adherence to the regulations governing its use. The application process, permitted usage guidelines, record-keeping requirements, and potential liabilities all demand careful attention. Misuse of the certificate can lead to significant financial penalties and legal repercussions.

The South Carolina resale certificate, therefore, represents both an opportunity and a responsibility. Businesses are strongly encouraged to proactively educate themselves on all aspects of its proper application and to consult with tax professionals when necessary. Maintaining compliance is not merely a legal obligation but a critical component of sustainable business practices. A diligent approach to the document is essential for leveraging its advantages while mitigating potential risks and contributing to a fair and transparent marketplace.