A standardized document that provides a pre-designed framework for creating records related to a specific type of savings account. This framework typically includes sections for specifying the principal amount, interest rate, maturity date, and other pertinent terms. As an example, a financial institution might provide a fill-in-the-blank form that customers use to establish a fixed-term deposit, ensuring all required information is collected uniformly.

Such standardized documents offer several advantages. They streamline the account creation process, reducing the potential for errors and omissions. Historically, these forms ensured consistent record-keeping, facilitating regulatory compliance and internal auditing. The use of these frameworks benefits both the financial institution and the customer by providing a clear and understandable agreement.

The following sections will delve into the specific elements commonly found within these documents, explain how to utilize them effectively, and discuss their role in financial planning and management.

1. Standardized Data Fields

The use of standardized data fields within a framework for creating records related to specific types of savings accounts is crucial for operational efficiency and accuracy. The data fields, which include elements such as the principal amount, interest rate, account holder details, and maturity date, facilitate uniform data entry and retrieval across all accounts. Without standardization, inconsistencies in data formats would lead to increased processing time, potential for errors, and difficulties in generating accurate financial reports. For instance, if one record stores the interest rate as a decimal (e.g., 0.03) while another uses a percentage (e.g., 3%), aggregation and analysis become problematic.

The implementation of these standardized fields directly affects the account opening process. By providing pre-defined input areas with specific validation rules (e.g., requiring a numerical value for the principal amount), institutions can reduce the likelihood of data entry errors. Furthermore, a standardized layout ensures that all essential information is captured, which is vital for regulatory compliance. Consider the requirement to report interest income to tax authorities; a standardized field for the taxpayer identification number (TIN) minimizes errors in reporting and reduces the risk of penalties. The establishment of a well-defined structure permits efficient system integration and data exchange, reducing the risk of data migration errors during system updates.

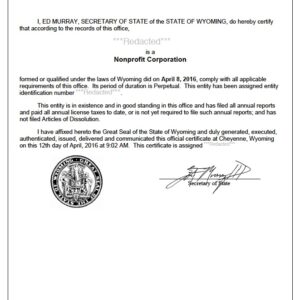

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

In summary, standardized data fields are fundamental to the efficacy and reliability of the entire system. Their meticulous design and implementation lead to improved data quality, enhanced regulatory compliance, and reduced operational risks. The adoption of industry standards and best practices in data field design reinforces the stability and security of financial systems.

2. Legal Compliance Adherence

The integration of legal compliance standards within a framework for creating records related to specific types of savings accounts is essential to maintaining institutional integrity and mitigating legal risk. These pre-designed frameworks must reflect current regulations and industry best practices.

-

Disclosure Requirements

Federal and state laws mandate specific disclosures be provided to customers before they purchase a fixed-term deposit. The framework must facilitate the clear and conspicuous presentation of information such as interest rates, early withdrawal penalties, and the method of interest calculation. Failure to adequately disclose these terms can lead to regulatory sanctions and legal action.

-

Truth in Savings Act (TISA) Compliance

In the United States, TISA requires financial institutions to disclose certain information about deposit accounts, including the annual percentage yield (APY), fees, and account terms. The framework must enable the accurate calculation and presentation of the APY and ensure all required disclosures are included within the documentation. Non-compliance with TISA can result in substantial fines and penalties.

-

Anti-Money Laundering (AML) Regulations

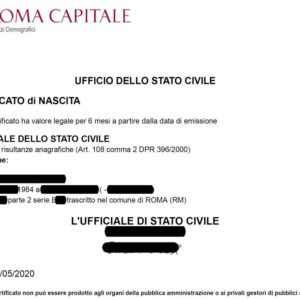

Suggested read: Email for Italian Birth Certificate? Get it Now!

Financial institutions are obligated to comply with AML regulations, including the Bank Secrecy Act. The framework must incorporate procedures for verifying customer identity, monitoring transactions for suspicious activity, and reporting any suspected money laundering. This typically involves collecting and documenting customer information and maintaining detailed transaction records.

-

Data Protection and Privacy

Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on the collection, storage, and use of customer data. The framework must include provisions for obtaining customer consent, protecting sensitive information, and ensuring data is used only for legitimate purposes. Failure to comply with data protection laws can lead to significant financial penalties and reputational damage.

In summary, strict adherence to legal and regulatory mandates is critical in the design and implementation of standardized fixed-term deposit documentation. The integration of these compliance measures protects both the institution and its customers by ensuring transparency, security, and adherence to established legal standards. Failure to comply can result in severe legal and financial repercussions.

3. Error Reduction Mechanisms

The integration of error reduction mechanisms within a standardized framework for fixed-term deposit accounts significantly impacts data integrity and operational efficiency. These mechanisms act as preventative measures against inaccuracies that can arise during data entry, calculation, or document generation. A primary cause of errors stems from manual input of data, which is prone to human fallibility. The implementation of validation rules, such as data type constraints and range checks, mitigates this risk by ensuring that only permissible values are entered. For example, a field designated for the interest rate should only accept numerical values within a reasonable range, preventing the entry of erroneous characters or unrealistic figures. The inclusion of automated calculations, such as the computation of maturity dates based on the deposit term, reduces the potential for manual calculation errors and ensures consistency across all account records. Without these safeguards, inaccuracies can propagate through the system, leading to incorrect financial statements, regulatory reporting discrepancies, and potential customer disputes.

Consider a scenario where the interest rate is entered incorrectly during account setup. This error would affect the accrued interest, the maturity value, and the tax reporting. If undetected, it could result in the customer receiving an incorrect payment at maturity, leading to dissatisfaction and potential legal challenges. Error reduction mechanisms, such as automated reconciliation processes that compare calculated interest against expected values, can identify such discrepancies before they impact the customer. Furthermore, pre-populated fields, drop-down menus, and standardized formatting minimize the need for manual input, thereby reducing the probability of errors. The use of digital signatures and audit trails provides an additional layer of security and accountability, ensuring that all changes to the record are tracked and traceable, enabling efficient error detection and correction.

In summary, error reduction mechanisms are an essential component of a robust documentation system for fixed-term deposit accounts. Their implementation minimizes inaccuracies, enhances operational efficiency, and reduces the risk of financial loss and regulatory non-compliance. By proactively preventing errors, these mechanisms contribute to the overall stability and reliability of financial institutions. The continuous refinement and enhancement of these safeguards are critical to maintaining data integrity in an evolving regulatory landscape.

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

4. Streamlined Account Opening

The efficacy of account establishment processes is significantly enhanced through the structured framework provided by standardized documentation. The use of pre-designed forms directly contributes to a more efficient and less error-prone process, benefiting both the financial institution and the customer.

-

Reduced Processing Time

Standardized documentation eliminates the need for ad-hoc information gathering. Predefined fields prompt the customer to provide all necessary details in a structured manner. For instance, the deposit term, interest rate, and beneficiary information are clearly delineated, reducing ambiguity and minimizing the need for clarification from bank personnel. This focused approach decreases the overall time required to open an account, improving customer satisfaction and increasing staff productivity.

-

Minimized Data Entry Errors

Structured forms incorporate validation rules that prevent the entry of incorrect or incomplete information. Data type restrictions, such as requiring numerical input for the principal amount, reduce the likelihood of human error. Drop-down menus and pre-populated fields further minimize manual input, thereby enhancing data accuracy. These error reduction mechanisms translate to fewer discrepancies in account records and reduced operational costs associated with error correction.

-

Enhanced Compliance Adherence

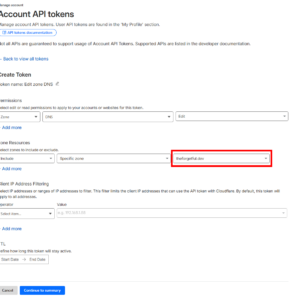

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

Standardized frameworks facilitate adherence to regulatory requirements by ensuring that all necessary disclosures are presented and acknowledged. The standardized format ensures the consistent application of AML procedures. Checkboxes and signature lines confirm that the customer has received and understood the terms and conditions. Compliance safeguards protect the institution from potential legal and financial penalties.

-

Improved Customer Experience

A clear and well-organized structure promotes a positive customer experience. The concise layout guides customers through the required steps, reducing confusion and frustration. Provision of a completed copy of the standardized document provides the customer with a clear record of the account terms, promoting transparency and trust. This streamlined approach contributes to improved customer retention and positive word-of-mouth referrals.

In conclusion, the adoption of structured forms fundamentally transforms account opening processes, resulting in reduced processing times, minimized errors, enhanced compliance, and improved customer satisfaction. These benefits underscore the critical role that standardized documentation plays in modern financial institution operations. The systematic approach is critical for ensuring that account opening processes are conducted in an efficient, secure, and compliant manner.

5. Recordkeeping Consistency

A standardized framework for fixed-term deposit accounts directly fosters recordkeeping consistency, an essential component for regulatory compliance, internal auditing, and customer service. The adoption of a structured documentation system necessitates uniform data entry protocols, ensuring that all relevant information, such as principal amounts, interest rates, and maturity dates, is recorded in a standardized format across all accounts. The use of pre-defined fields and validation rules minimizes the potential for discrepancies and inaccuracies, which are detrimental to maintaining accurate financial records. An example is a financial institution with multiple branches. If each branch employed different documentation practices, reconciling account information and generating consolidated reports would become exceptionally challenging. Standardized fixed-term deposit frameworks mitigate such inconsistencies, enabling efficient data aggregation and analysis.

Maintaining data integrity is pivotal for accurate financial reporting and regulatory compliance. Consistent recordkeeping facilitated by a standardized framework supports reliable audit trails, allowing regulators and internal auditors to trace transactions and verify compliance with applicable laws and regulations. Furthermore, consistent records enable prompt and accurate responses to customer inquiries. For instance, a customer seeking information about their account balance or maturity date can be provided with precise details derived from a uniformly maintained record. Conversely, a lack of recordkeeping consistency can lead to errors in financial statements, regulatory penalties, and damage to an institution’s reputation. This affects operational efficiency because resolving inconsistencies diverts resources from other core functions.

In summary, maintaining uniform records is essential for proper regulatory compliance and auditability. The structured documents act as a tool, but its true value is reflected in its use that creates records consistency. Despite the challenges of initial framework implementation, the long-term benefits of enhanced data quality, reduced errors, and improved compliance significantly outweigh these costs. As regulations evolve, consistent frameworks must be updated to ensure continued adherence to legal and industry standards.

Suggested read: Free Volunteer Certificate: Get Yours Now!

Frequently Asked Questions

This section addresses common inquiries regarding standardized frameworks for creating records related to specific types of savings accounts, focusing on their implementation, usage, and benefits.

Question 1: What constitutes a standardized framework in the context of fixed-term deposit accounts?

A standardized framework is a pre-designed structure, often a digital or physical document, that provides a consistent format for capturing essential details related to a fixed-term deposit account. It includes designated fields for information such as the principal amount, interest rate, account holder details, and maturity date, ensuring uniform data collection across all accounts.

Question 2: What are the primary advantages of implementing a standardized documentation system for fixed-term deposits?

The principal benefits include enhanced data integrity, reduced errors, improved regulatory compliance, and streamlined account opening processes. A consistent framework facilitates efficient data retrieval, accurate financial reporting, and adherence to legal mandates, minimizing the risk of discrepancies and penalties.

Suggested read: Last Minute Valentines Gift Certificate - Now!

Question 3: How do standardized documentation systems contribute to regulatory compliance?

These systems integrate compliance measures by ensuring that all required disclosures, such as those mandated by the Truth in Savings Act (TISA), are presented and acknowledged. The framework also facilitates adherence to Anti-Money Laundering (AML) regulations by including fields for customer verification and transaction monitoring.

Question 4: What mechanisms are typically included to minimize errors in these documentation systems?

Common error reduction mechanisms include data validation rules, which restrict the type and range of acceptable input values; automated calculations, such as those for maturity dates; and pre-populated fields and drop-down menus, which reduce the need for manual data entry.

Suggested read: Get Your Type Examination Certificate Fast!

Question 5: How do standardized documents improve the account opening process for both the financial institution and the customer?

They expedite the account opening process by providing a clear and organized structure for collecting required information. The pre-designed format reduces the need for clarification, minimizes data entry errors, and ensures all necessary disclosures are provided, resulting in a more efficient and satisfactory experience for both parties.

Question 6: What are the potential consequences of not using a standardized documentation system for fixed-term deposit accounts?

Failure to adopt a standardized system can lead to increased errors, regulatory non-compliance, inefficiencies in data management, and potential customer disputes. Inaccurate records can result in incorrect financial statements, regulatory penalties, and reputational damage to the institution.

In summary, a standardized framework for creating records related to specific types of savings accounts offers significant benefits in terms of accuracy, efficiency, and compliance. Proper implementation and usage are essential for realizing these advantages and mitigating the risks associated with inconsistent recordkeeping.

Suggested read: Printable Souvenir Birth Certificate Template - Fun Keepsake!

The next section will address practical considerations for selecting and implementing a standardized framework for fixed-term deposit accounts.

Tips for Optimizing Fixed-Term Deposit Documentation

Effective utilization of a standardized framework for creating records related to specific types of savings accounts requires attention to key details that will enhance data accuracy, streamline processes, and ensure regulatory compliance. These tips provide guidance on maximizing the benefits derived from such frameworks.

Tip 1: Implement Robust Data Validation Rules: Data validation is crucial for ensuring data accuracy. Implement data type restrictions, range checks, and required field validations to prevent erroneous input. For instance, an interest rate field should only accept numerical values within a predefined range, and the account holder’s name should be a required field.

Tip 2: Automate Calculations Whenever Possible: Manual calculations are prone to errors. Automate the calculation of maturity dates, interest accrual, and other relevant values. This reduces the risk of inaccuracies and ensures consistency across all accounts. Regularly verify the accuracy of automated calculations against expected values.

Tip 3: Establish Clear and Concise Data Entry Guidelines: Create explicit instructions for filling out the forms. Specify the format for dates, names, and other critical information. Provide examples of acceptable entries to minimize ambiguity and promote uniformity among different users.

Tip 4: Integrate Document Version Control: Maintain strict version control over the framework to manage updates and revisions. Each version should be clearly labeled with a date and description of the changes made. Ensure that all users are working with the latest approved version of the framework.

Tip 5: Regularly Audit Documentation for Compliance: Conduct periodic audits to ensure that the framework adheres to current regulatory requirements. Verify that all required disclosures are included and that customer data is handled in accordance with privacy laws. Address any identified deficiencies promptly.

Suggested read: Get Your SC Resale Certificate: Guide & Apply Today

Tip 6: Provide Comprehensive Training to Staff: Training personnel on the proper use of the framework is essential for maximizing its effectiveness. Provide training sessions on data entry protocols, compliance requirements, and error correction procedures. Regularly update training materials to reflect changes in regulations and institutional policies.

Tip 7: Incorporate Customer Feedback: Gather feedback from customers regarding the clarity and usability of the framework. Use this input to identify areas for improvement and enhance the overall customer experience. Customer-centric design can improve compliance rates and data accuracy.

By implementing these strategies, institutions can optimize the use of a standardized framework to enhance data quality, streamline operations, and ensure compliance with applicable laws and regulations. The meticulous application of these tips directly contributes to improved accuracy, regulatory adherence, and operational excellence.

The following section will delve into the future trends related to the management of standardized fixed-term deposit documentation.

Conclusion

This exploration of the `certificate of deposit template` underscores its critical role in financial institutions. It facilitates regulatory compliance, mitigates risk through standardized data capture, and streamlines operational workflows. The diligent application of such a framework ensures data integrity and supports accurate financial reporting, essential for institutional stability.

Given the increasing complexity of financial regulations and the growing emphasis on data security, the careful selection and implementation of a `certificate of deposit template` remains a paramount consideration. Proactive refinement and adaptation to evolving legal standards is crucial for maintaining operational efficiency and ensuring continued adherence to industry best practices, with the potential result being the long-term financial stability of any organization involved.