A document issued by the Louisiana Department of Revenue allows registered businesses to purchase goods without paying sales tax, provided those goods are acquired for the purpose of resale. This certificate streamlines transactions by eliminating the need for the retailer to collect sales tax from the purchasing business, as the tax will be collected when the goods are eventually sold to the end consumer. For example, a clothing boutique can use this certification to purchase apparel from a wholesaler without paying sales tax at the time of purchase.

Possessing this certification offers significant advantages for eligible businesses. It improves cash flow by deferring the sales tax payment until the final sale, freeing up capital for other operational expenses. It also simplifies accounting processes by removing the need to track and reconcile sales tax on wholesale purchases. The history of such certifications reflects a long-standing effort to avoid taxing the same goods multiple times within the distribution chain, promoting efficiency in commercial transactions.

The following sections will detail the requirements for obtaining this vital credential, the responsibilities that come with its use, and the potential consequences of misuse. Furthermore, information will be provided on how to properly manage and renew this document to ensure continued compliance with Louisiana state tax laws.

1. Eligibility requirements

The criteria to qualify for a Louisiana resale authorization are meticulously defined by the Department of Revenue. Meeting these prerequisites is essential for businesses seeking to procure inventory tax-free for subsequent resale, aligning with the states tax regulations and facilitating compliant business operations.

-

Active Sales Tax Account

Suggested read: Get Your SC Resale Certificate: Guide & Apply Today

A prerequisite is maintaining a current and active sales tax account with the Louisiana Department of Revenue. This status indicates that the business is registered to collect and remit sales tax on its taxable sales within the state. A lapsed or suspended sales tax account will disqualify an applicant.

-

Legitimate Business Operation

The applicant must demonstrate a genuine business operation with the clear intention of reselling tangible personal property. This involves providing documentation such as a business license, articles of incorporation, or other official paperwork that substantiates the business’s existence and purpose. Businesses operating solely for personal consumption or with an unclear resale intent will not meet this criterion.

-

Physical Presence or Nexus in Louisiana

Typically, businesses must have a physical presence or sufficient nexus within Louisiana to qualify. Nexus refers to a significant connection to the state, such as a physical location, employees, or substantial sales activity. This presence establishes the state’s jurisdiction for tax purposes and ensures the business can be held accountable for collecting and remitting sales tax on its eventual sales.

-

Absence of Delinquent Tax Obligations

Businesses with outstanding or delinquent tax obligations to the State of Louisiana are generally ineligible. The Department of Revenue prioritizes compliance and expects applicants to be in good standing regarding their tax liabilities. Resolution of any outstanding tax debts is often a requirement before a certificate will be issued.

Suggested read: IN Resale Certificate: Easy Guide + Apply Now!

These interconnected prerequisites collectively ensure that only legitimate, tax-compliant businesses operating with the intent of reselling tangible goods are granted the privilege of purchasing inventory without upfront sales tax. Failure to satisfy any of these conditions will preclude a business from obtaining this authorization, potentially impacting its ability to manage cash flow and operate efficiently within Louisianas commercial landscape.

2. Application process

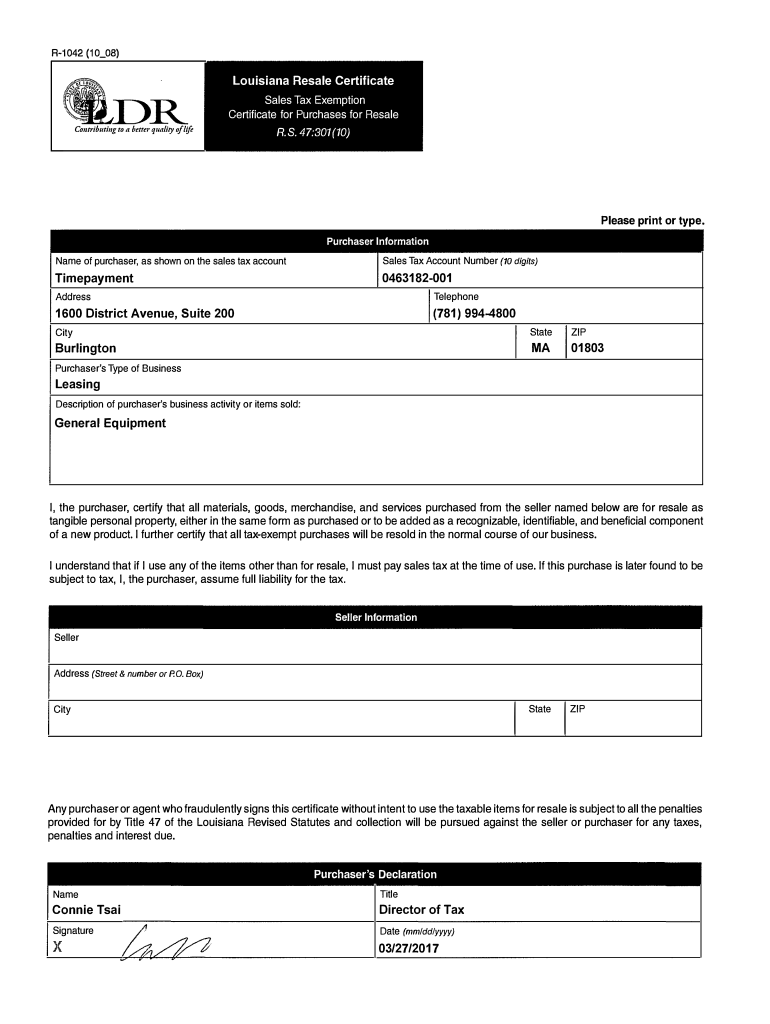

The application procedure is the foundational gateway to obtaining a Louisiana resale authorization. It is the formalized mechanism through which businesses formally request the privilege of purchasing goods for resale without incurring immediate sales tax. A correctly completed application, submitted with all required documentation, initiates a review process by the Department of Revenue. The accuracy and completeness of this submission directly affects the speed and outcome of the application. For example, failure to provide a valid Louisiana sales tax account number or neglecting to accurately describe the nature of the business can lead to delays or denial of the certificate.

The process typically involves completing a specific form provided by the Department of Revenue, either online or in paper format. This form requires detailed information about the business, including its legal name, address, sales tax account number, and a description of the goods intended for resale. Supporting documentation, such as copies of the business license, articles of incorporation, and any other relevant permits, must be included. A business selling clothing, for instance, will need to clearly state this intention and provide documentation demonstrating its retail sales activity. The department scrutinizes this information to verify the legitimacy of the business and its adherence to state tax laws.

The application process is not merely a formality; it is a crucial step in ensuring that resale authorization is granted only to legitimate businesses intending to comply with state tax regulations. Understanding this process, diligently preparing the required documentation, and responding promptly to any inquiries from the Department of Revenue are essential for businesses seeking to efficiently manage their cash flow and remain compliant with Louisiana sales tax laws. Accurate completion of the process minimizes the risk of denial and ensures timely access to the benefits afforded by the certificate.

3. Permitted uses

The scope of authorization dictates the appropriate applications of a Louisiana resale document. This authorization allows registered businesses to procure tangible personal property without remitting sales tax at the point of purchase. However, this exemption is strictly contingent upon the condition that the purchased items are intended solely for resale in the ordinary course of business. A wholesaler of electronic components, for example, is permitted to use this certificate to acquire inventory from a manufacturer, deferring the sales tax obligation until the components are sold to retailers or end consumers.

Conversely, unauthorized applications constitute a misuse of the certificate and carry significant consequences. The purchase of items for internal use, consumption, or any purpose other than direct resale is strictly prohibited. To illustrate, a restaurant owner cannot utilize this document to acquire kitchen equipment or furniture, as these items are not intended for resale but rather for the operation of the business. Similarly, a construction company cannot use the certificate to buy building materials used in a construction project, even if the project is for a customer, because the materials are incorporated into the real property and not resold as tangible personal property.

Understanding and adhering to the limitations surrounding authorized applications of the document is critical for Louisiana businesses. The Department of Revenue actively monitors certificate usage, and instances of misuse can result in penalties, including revocation of the authorization and assessment of unpaid sales tax, interest, and penalties. Therefore, businesses must establish internal controls to ensure that the certificate is used solely for its intended purpose: the tax-exempt purchase of goods intended for resale to customers.

Suggested read: Get Your Florida Resale Certificate Fast!

4. Renewal stipulations

Renewal stipulations form a critical aspect of maintaining a valid Louisiana resale authorization. These stipulations dictate the conditions and procedures that businesses must adhere to in order to continue purchasing goods tax-exempt for resale. Compliance with these requirements is not optional; failure to meet them can result in the lapse or revocation of the certificate, impacting a business’s ability to efficiently manage inventory costs.

-

Timely Application Submission

A key facet is the necessity of submitting a renewal application within the specified timeframe mandated by the Louisiana Department of Revenue. Typically, renewal applications must be submitted prior to the expiration date of the existing certificate. Failure to submit the application on time can lead to a temporary or permanent lapse in the resale authorization, requiring the business to pay sales tax on purchases until the certificate is reinstated. For instance, a business with a certificate expiring on December 31st must submit its renewal application well in advance to avoid any disruption in its ability to purchase inventory tax-free.

-

Maintenance of Active Sales Tax Account

Maintaining an active and compliant sales tax account is often a fundamental condition for renewal. This signifies that the business is consistently fulfilling its obligations to collect and remit sales tax on its taxable sales within Louisiana. Any instances of delinquency, non-filing, or underreporting of sales tax can jeopardize the renewal process. If a business accumulates unpaid sales tax liabilities, the Department of Revenue may deny the renewal application until these obligations are resolved, potentially impacting the business’s cash flow and operational efficiency.

-

Verification of Continued Eligibility

During the renewal process, the Department of Revenue may re-evaluate the business’s eligibility for the document. This involves confirming that the business continues to operate with the primary intent of reselling tangible personal property. If the business’s operations have changed significantly since the initial application for example, if it has shifted its focus to providing services rather than selling goods the department may require additional documentation or clarification to ensure continued eligibility. A business that initially operated as a retail store but has transitioned to a service-based model may face challenges in renewing its certificate if it cannot demonstrate a substantial volume of resale activity.

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

-

Adherence to Regulatory Changes

Louisiana tax laws and regulations are subject to change, and businesses seeking renewal must demonstrate their awareness and compliance with any updates that may have occurred since the initial issuance of the certificate. This may involve attending informational seminars, reviewing publications from the Department of Revenue, or consulting with a tax professional. For example, if the state has implemented new reporting requirements or modified the definition of taxable goods, businesses must demonstrate that they have adapted their practices accordingly to maintain compliance and secure renewal.

In conclusion, these intertwined stipulations underscore the importance of proactive management and consistent compliance in maintaining the privilege of purchasing goods tax-exempt for resale in Louisiana. Timely submission, adherence to tax obligations, demonstration of continued eligibility, and adaptation to regulatory changes are all essential components of a successful renewal process, ensuring uninterrupted access to the benefits afforded by the resale document.

5. Consequences of misuse

The improper application of a Louisiana resale authorization carries significant repercussions, underscoring the gravity with which the Department of Revenue views compliance. These ramifications extend beyond mere financial penalties, potentially impacting a business’s operational capabilities and reputation.

-

Assessment of Unpaid Sales Tax

The primary consequence of improper authorization utilization involves the retroactive assessment of unpaid sales tax on all transactions where the authorization was misused. This includes not only the tax amount itself but also accrued interest from the date the tax should have been remitted. For instance, if a business improperly used its authorization to purchase office supplies, it will be liable for the sales tax that should have been paid at the time of purchase, along with applicable interest charges. This financial burden can be substantial, especially if misuse has occurred repeatedly over an extended period.

-

Imposition of Penalties

Suggested read: Email for Italian Birth Certificate? Get it Now!

Beyond the assessment of unpaid taxes and interest, the Department of Revenue can impose additional penalties for misuse. These penalties are typically calculated as a percentage of the unpaid tax and can vary based on the severity and frequency of the misuse. Intentional or repeated misuse may result in higher penalty assessments. If a business deliberately misrepresents its intent to resell goods in order to avoid paying sales tax, it may face significant penalty charges, further exacerbating the financial strain.

-

Revocation of Resale Authorization

One of the most severe consequences is the revocation of the authorization itself. This effectively eliminates the business’s ability to purchase goods tax-exempt for resale, significantly impacting its cash flow and operational efficiency. Once revoked, reinstatement of the authorization may require a formal appeal process and demonstration of corrective measures to prevent future misuse. A business dependent on tax-exempt purchasing to maintain competitive pricing may find its operations severely hampered by revocation.

-

Potential Legal Action

In cases of egregious or deliberate misuse, the Department of Revenue may pursue legal action against the business and its responsible parties. This can include civil lawsuits to recover unpaid taxes, interest, and penalties, as well as potential criminal charges for tax evasion or fraud. The legal ramifications can result in significant financial liabilities, reputational damage, and potential incarceration for individuals involved. A business engaging in systematic abuse of the authorization to avoid sales tax may face severe legal consequences, impacting its long-term viability and the personal assets of its owners.

These interconnected consequences underscore the importance of meticulous compliance with the regulations surrounding the use of Louisiana resale authorizations. The potential financial, operational, and legal ramifications of misuse serve as a strong deterrent, emphasizing the need for businesses to establish robust internal controls and training programs to ensure proper utilization and avoid unintentional or deliberate violations.

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

Frequently Asked Questions About Resale Authorization in Louisiana

This section addresses common inquiries regarding the Louisiana resale document, offering clarity on its purpose, usage, and compliance requirements.

Question 1: What constitutes valid use of a Louisiana resale certificate?

A valid application involves the purchase of tangible personal property solely for the purpose of reselling it in the ordinary course of business. Items acquired must be directly offered for sale to customers, without any intervening use or consumption by the purchasing business.

Question 2: Can the authorization be used to purchase items for internal business use?

No. The purchase of items intended for internal consumption, use in the business operations, or any purpose other than direct resale is strictly prohibited. Misuse in this manner constitutes a violation of state tax laws.

Question 3: What are the penalties for misusing the Louisiana resale document?

Misuse can result in the assessment of unpaid sales tax, interest charges, penalties, and the potential revocation of the authorization. Egregious or repeated misuse may also lead to legal action by the Department of Revenue.

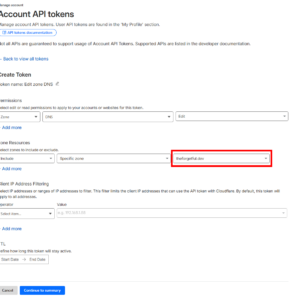

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

Question 4: How does a business apply for a renewal of its resale document?

Renewal typically requires submitting an application to the Louisiana Department of Revenue prior to the expiration date of the existing authorization. The business must maintain an active sales tax account and demonstrate continued eligibility.

Question 5: Is a resale authorization transferable to another business entity?

No. The authorization is specific to the business entity to which it was issued and is not transferable to another entity, even if under common ownership. A separate application is required for each distinct business.

Question 6: What documentation is required to support the legitimate use of a Louisiana resale authorization during an audit?

Businesses must maintain detailed records of all purchases made using the authorization, including invoices, sales records, and any other documentation that demonstrates the goods were acquired for resale. This documentation is essential for substantiating compliance during audits by the Department of Revenue.

Accurate understanding and consistent adherence to these guidelines are paramount for Louisiana businesses utilizing resale authorization. Proactive compliance mitigates the risk of penalties and ensures the continued benefit of tax-exempt purchasing for resale operations.

Suggested read: Free Volunteer Certificate: Get Yours Now!

The subsequent section offers further insights into best practices for managing a Louisiana resale authorization effectively.

Essential Guidelines for “resale certificate louisiana”

The subsequent recommendations are crucial for businesses leveraging a Louisiana resale document, ensuring both operational efficiency and adherence to state tax regulations.

Tip 1: Maintain meticulous records. Diligent record-keeping is essential. Retain all invoices, purchase orders, and sales records associated with transactions using the authorization. These documents serve as primary evidence of compliant usage during audits by the Department of Revenue.

Tip 2: Train employees thoroughly. Ensure that all personnel involved in purchasing and sales are comprehensively trained on the proper use and limitations of the document. Misunderstanding can lead to inadvertent misuse and subsequent penalties.

Tip 3: Conduct periodic internal audits. Regularly review purchasing practices to verify that the authorization is being used correctly. This proactive measure can identify and correct potential issues before they escalate into compliance violations.

Tip 4: Verify vendor acceptance. Confirm that vendors accept the Louisiana resale authorization prior to making tax-exempt purchases. Not all vendors are required to honor it, and attempting to use it with a non-accepting vendor can create complications.

Tip 5: Stay informed about regulatory changes. Louisiana tax laws and regulations are subject to change. Businesses must remain current on any updates that may affect the use of the authorization. Subscribe to Department of Revenue publications and attend relevant seminars to stay informed.

Suggested read: Last Minute Valentines Gift Certificate - Now!

Tip 6: Securely store the document. The authorization should be stored securely to prevent unauthorized use. Limit access to authorized personnel only, and implement controls to track its usage.

Tip 7: Review your sales tax account periodically: Regularly check that your sales tax account with the Department of Revenue is in good standing. Any delinquencies or discrepancies could jeopardize the renewal of the “resale certificate louisiana”.

Adhering to these guidelines significantly mitigates the risk of misuse and ensures that businesses can continue to benefit from tax-exempt purchasing, streamlining operations and enhancing financial performance.

The concluding section of this article summarizes key takeaways and emphasizes the importance of compliance for Louisiana businesses utilizing this critical document.

Conclusion

This exploration has illuminated the essential aspects of the Louisiana resale document. From eligibility and application to permitted uses, renewal stipulations, and the consequences of misuse, the information provided is intended to offer a comprehensive understanding of this vital instrument for Louisiana businesses. Proper management and responsible application are not merely recommended but mandated for compliance.

The continued success and operational efficiency of businesses in Louisiana are inextricably linked to their adherence to state tax regulations regarding this certification. Businesses should take seriously the responsibilities inherent in possessing this authorization, ensuring its proper use to avoid penalties and maintain a compliant, thriving enterprise. Diligence and accurate understanding are the cornerstones of effective utilization and enduring business prosperity within the state.