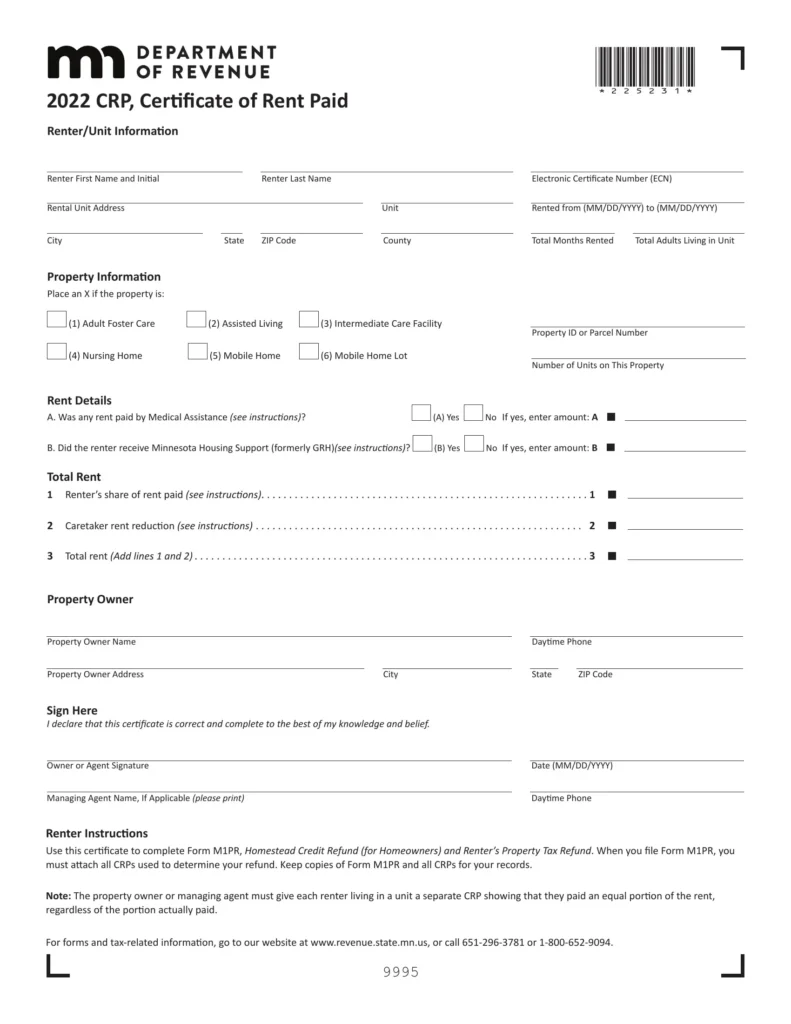

The form provided by renters in Minnesota to claim a property tax refund based on the amount of rent paid. It allows eligible renters to receive a refund that helps offset the portion of their rent that goes toward property taxes. Landlords or property managers are responsible for issuing this document to each renter by January 31st of the following year.

This mechanism provides significant financial relief to renters, particularly those with lower incomes, by allowing them to recoup a portion of the property taxes indirectly paid through their rent. The program has historical roots in efforts to alleviate the tax burden on individuals and families in Minnesota. It serves as an important part of the state’s broader tax relief framework, contributing to housing affordability and economic stability for renters.

Understanding the eligibility requirements, the information required on the document, and the process for claiming the refund is essential for both renters and landlords. The following sections will delve into these key aspects, providing a detailed overview of the program and its implications.

1. Eligibility Requirements

The issuance and utilization of the document are intrinsically linked to specific eligibility criteria established by the State of Minnesota. The form itself serves as a means for renters to substantiate their claim for a property tax refund, but only if they meet the defined requirements. These stipulations often include factors such as the renter’s income, the type of property rented, and the duration of occupancy. Failure to satisfy these prerequisites renders the provided certificate invalid for the purpose of claiming the refund. For example, a renter exceeding the income threshold, as defined by the state for that tax year, will not qualify for a refund, regardless of the information presented on the certificate. Therefore, meeting the eligibility criteria acts as a precondition for the relevant use of the document.

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

The process of claiming the credit requires that renters provide accurate and verifiable information related to their eligibility. This might involve documentation of their income, lease agreements, or other supporting materials. The accuracy of the information on the certificate, as provided by the landlord, is also crucial. Discrepancies between the information and the renter’s actual circumstances can lead to delays in processing the refund or even denial of the claim. For instance, if a landlord incorrectly reports the amount of rent paid, it can directly impact the calculation of the renter’s potential refund and raise questions about the renter’s eligibility.

In summary, understanding the eligibility prerequisites is fundamental to realizing the benefits associated with this document. The requirements function as a gatekeeper, determining who can legitimately access the property tax refund program. Challenges often arise from a lack of awareness regarding the specific criteria or from unintentional errors in the information provided. Therefore, proactive efforts to understand and comply with the requirements are essential for both renters and landlords seeking to participate in this system.

2. Rent amount

The rent amount constitutes a primary data point on the official form. This figure, representing the total rent paid by a tenant during the calendar year, directly dictates the potential property tax refund. An accurate reflection of the rent paid is essential; any discrepancy can lead to miscalculations in the refund amount, potentially resulting in either an overpayment or underpayment to the renter. For instance, if a tenant paid \$12,000 in rent over the year, that precise figure must be reported. If the form erroneously states \$11,000, the renter’s refund will be incorrectly calculated, likely resulting in a smaller refund than they are entitled to.

Furthermore, the reported rent amount impacts not only the individual renter but also the overall efficacy of the property tax refund program. The aggregate of all reported rent figures contributes to the state’s understanding of housing costs and the effectiveness of the program in providing relief to renters. Landlords must maintain accurate records of rent payments to ensure the figures reported on the certificate align with actual payments received. This obligation underscores the importance of transparent financial record-keeping in the rental housing sector. Consider a scenario where multiple landlords consistently underestimate reported rent; this could paint a misleading picture of the true cost burden faced by renters across the state, potentially influencing future policy decisions.

In summary, the accuracy and verification of the rent amount reported on this form are critical. It acts as a direct input in the calculation of individual renter refunds and also contributes to the broader assessment of housing affordability within the state. Challenges related to record-keeping, payment verification, and potential errors in reporting must be addressed to maintain the integrity of the program and ensure its effectiveness in providing equitable tax relief to eligible renters. The rent amount reported serves as the keystone for a reliable and impactful tax relief system.

3. Property tax

The underlying rationale for the existence of the mechanism stems directly from property taxes levied on landlords and property owners. Rent, in part, represents a pass-through of these property tax obligations from the property owner to the renter. The certificate serves as the documentation necessary for renters to claim a refund based on their portion of these property taxes, albeit indirectly paid. Without the existence of property taxes, the need for this certificate and its associated refund system would be negated. A real-life example is the scenario of a rental property owner paying significantly higher property taxes due to improvements or increased assessed value; this increase, in turn, may lead to higher rents charged to tenants, thus increasing the potential refund amount reflected on the certificate.

Suggested read: Email for Italian Birth Certificate? Get it Now!

The amount of property tax paid by the landlord directly influences the potential refund a renter can receive. State algorithms and formulas utilize the rent amount reported on the document, combined with factors related to the renter’s income and household size, to determine the refund amount. However, this calculation is predicated on the existence and magnitude of property taxes paid by the landlord. Therefore, variations in property tax rates and assessments across different localities in Minnesota have a direct impact on the amount of rent paid, and, consequently, the refund potential for renters. For instance, rental units located in areas with high property tax rates are likely to command higher rents, potentially leading to a greater property tax refund for the tenant.

In summary, property tax serves as the fundamental driver of the process. It is the cause, with the certificate and subsequent refund acting as the effect. Understanding this connection is vital for both renters and landlords to comprehend the systems purpose and function. Challenges in accurately assessing and managing property taxes can inadvertently impact the fairness and effectiveness of the renter’s property tax refund program. Recognizing the inherent link allows for a more informed approach to housing affordability and tax policy within Minnesota.

4. Filing deadline

The filing deadline represents a critical temporal boundary dictating the validity of the document for claiming a property tax refund. The Minnesota Department of Revenue establishes a specific date by which renters must submit their claim, along with the required certificate, to be eligible for a refund. This deadline is non-negotiable; failure to adhere to it results in forfeiture of the refund for that tax year. For example, if the filing deadline is August 15th, submitting the claim on August 16th renders the certificate, regardless of its accuracy, useless for obtaining a refund.

The imposition of a filing deadline serves several practical purposes. It allows the Department of Revenue to efficiently process claims within a defined timeframe, ensuring timely distribution of refunds and minimizing administrative burdens. The deadline also encourages renters to promptly gather necessary documentation, reducing the likelihood of errors or delays in processing. A common scenario involves renters delaying the filing process until the last minute, potentially leading to mistakes in their application or a failure to meet the deadline due to unforeseen circumstances. Understanding the fixed nature of this deadline is therefore essential for successful participation in the property tax refund program.

In summary, the filing deadline acts as a strict constraint governing the use of the document. Missing this deadline results in the irreversible loss of the opportunity to claim a refund, regardless of the renters eligibility or the accuracy of the certificate. Awareness of this deadline and proactive preparation are crucial to ensure renters can benefit from the property tax refund program. Challenges arise when renters are unaware of the deadline or fail to prioritize the filing process. Consequently, emphasizing the importance of timely submission is paramount for maximizing participation and providing effective tax relief to eligible renters in Minnesota.

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

5. Refund calculation

The refund calculation is intrinsically dependent on the data presented on the form. The amount of rent paid, as documented on the form, directly factors into the formula used by the Minnesota Department of Revenue to determine the eligible refund. Other variables, such as the renter’s income and the number of dependents, are also considered, but the reported rent serves as a foundational element in the overall calculation. An inflated or deflated rent amount on the certificate will directly alter the refund amount, illustrating the direct cause-and-effect relationship. For example, if a certificate reports rent paid as $10,000 when it was actually $12,000, the calculated refund will be lower than what the renter is rightfully entitled to.

The calculation process, while complex, aims to provide equitable property tax relief to renters based on their financial circumstances and the rent they pay, reflecting the pass-through of property tax costs. The accuracy of the information contained on the form is therefore of paramount importance. Furthermore, an understanding of the calculation methodology empowers renters to verify the refund amount calculated by the Department of Revenue. Renters can use online calculators provided by the state to independently estimate their refund, allowing them to identify potential discrepancies between their estimate and the official calculation.

In summary, the refund calculation is not separate from the certificate; it is a direct consequence of the data it contains. Accurate and verifiable information on the form ensures a fair and correct refund amount. Potential challenges often arise from a lack of transparency in the calculation methodology or from errors in the data reported on the certificate. Thus, a clear understanding of the inputs and the calculation process is essential for all parties involved, ensuring renters receive the appropriate property tax relief.

6. Landlord responsibilities

Landlord responsibilities are inextricably linked to the accurate and timely issuance of the document. The State of Minnesota places specific obligations on landlords to ensure renters can successfully claim their property tax refund. Fulfilling these responsibilities is essential for the proper functioning of the program and for maintaining trust between landlords, tenants, and the state government.

-

Provision of Accurate Certificates

Landlords are legally obligated to provide renters with an accurate certificate by January 31st of the year following the year for which rent was paid. The information on the certificate, including the total rent paid and the property’s address, must be correct. Failure to provide accurate information can result in penalties for the landlord and can prevent renters from receiving their entitled refund. For example, if a landlord misreports the total rent paid due to poor record-keeping, it can trigger an audit or legal action.

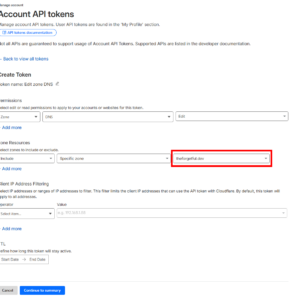

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

-

Timely Issuance of Certificates

The certificate must be provided to renters by the specified deadline. Late issuance of the form can prevent renters from filing their property tax refund claim on time, leading to a loss of the refund. The Department of Revenue typically allows renters an extended period to file, but reliance on renters to request a document places an unnecessary burden on the renter, violating the program’s intended efficiency. Delays caused by incomplete contact information on renters’ leases or turnover can be resolved by confirming contact information prior to the cutoff date.

-

Record-Keeping and Documentation

Landlords are expected to maintain thorough and accurate records of rent payments received from tenants. These records serve as the basis for the information provided on the certificate and may be subject to audit by the Department of Revenue. Proper documentation protects landlords from potential disputes with renters or challenges from the state. An example includes keeping copies of all rent receipts, lease agreements, and any communication regarding rent payments.

-

Responding to Tenant Inquiries

Landlords should be responsive to inquiries from renters regarding the certificate. Renters may have questions about the information on the form or the process for claiming the refund. Landlords are responsible for providing clarification and assistance to ensure renters understand their rights and responsibilities. For example, a landlord should be able to explain how the total rent amount was calculated or provide additional documentation if requested.

Suggested read: Free Volunteer Certificate: Get Yours Now!

In conclusion, landlord responsibilities associated with this document are not merely administrative tasks; they are legal obligations that directly impact renters’ ability to access property tax relief. By fulfilling these responsibilities diligently, landlords contribute to the integrity of the program and foster positive relationships with their tenants. Failure to comply with these obligations can lead to penalties, legal disputes, and a breakdown of trust within the rental housing market.

Frequently Asked Questions Regarding Minnesota Certificate of Rent Paid

This section addresses common inquiries and clarifies misconceptions pertaining to the official document, ensuring a comprehensive understanding of its purpose and application.

Question 1: What constitutes the purpose of this official document?

The primary purpose is to allow eligible renters in Minnesota to claim a refund for a portion of the property taxes paid by their landlord, which is indirectly passed on to renters through rent payments. The certificate serves as proof of rent paid for the tax year in question.

Question 2: Who bears the responsibility for providing renters with this form?

Suggested read: Last Minute Valentines Gift Certificate - Now!

Landlords or property managers are legally obligated to furnish each renter with a completed form by January 31st of the year following the year for which the rent was paid. Failure to comply may result in penalties.

Question 3: What details are contained within the document, and why is their accuracy critical?

The document includes the total rent paid during the calendar year, the property’s address, and the landlord’s information. Accuracy is paramount because the reported rent figure directly influences the potential refund amount calculated by the Minnesota Department of Revenue.

Question 4: If a renter fails to receive the certificate by the deadline, what recourse is available?

Renters should first contact their landlord to request the certificate. If the landlord remains unresponsive, the renter may contact the Minnesota Department of Revenue for guidance on alternative methods for claiming the refund.

Question 5: What action should be taken if discrepancies are observed between the rent paid and the amount reported on the certificate?

Suggested read: Get Your Type Examination Certificate Fast!

Renters should immediately contact their landlord to rectify the discrepancy. Supporting documentation, such as rent receipts, may be required to validate the claim.

Question 6: Is there a specific deadline by which renters must file their property tax refund claim using this document?

Yes, the Minnesota Department of Revenue establishes a filing deadline each year. Failure to meet this deadline results in the forfeiture of the refund for that tax year. The specific deadline is published annually and can be found on the Department of Revenue’s website.

Accurate completion, timely filing, and adherence to state regulations are critical to claiming the correct property tax refund as a renter in Minnesota.

The subsequent section will address common challenges related to this certificate and offer solutions for effective navigation of the system.

Suggested read: Printable Souvenir Birth Certificate Template - Fun Keepsake!

Tips Regarding Minnesota Certificate of Rent Paid

The following guidelines offer a practical framework for managing the document effectively, ensuring compliance, and maximizing benefits.

Tip 1: Maintain meticulous records of all rent payments. Document each payment with details such as date, amount, and method of payment. This practice provides verifiable evidence to support the information on the document and resolve potential discrepancies.

Tip 2: Landlords should issue forms promptly and accurately. Distribute the certificate to each renter by the January 31st deadline. Verify the accuracy of all information, including the property address, rental period, and total rent paid, to prevent errors that could jeopardize a renter’s refund eligibility.

Tip 3: Renters must verify the information provided on the certificate. Carefully review the certificate upon receipt to ensure it accurately reflects the rent paid during the tax year. If discrepancies are found, contact the landlord immediately for correction.

Tip 4: Retain a copy of the completed document for personal records. Keeping a copy of the certificate, along with supporting documentation, provides a reference point for future inquiries or audits by the Minnesota Department of Revenue.

Tip 5: Understand the eligibility requirements for claiming the property tax refund. Familiarize yourself with income limitations, occupancy duration requirements, and other eligibility criteria established by the state. Ensure these requirements are met before filing a claim.

Suggested read: Get Your SC Resale Certificate: Guide & Apply Today

Tip 6: Renters need to file their property tax refund claims promptly. Adhere to the filing deadline set by the Minnesota Department of Revenue to avoid forfeiting the refund. Plan and gather necessary documentation well in advance of the deadline.

By following these guidelines, renters and landlords can navigate the complexities surrounding this certificate with greater confidence, ensuring accurate reporting, timely filing, and maximized benefits under the property tax refund program.

The subsequent sections will delve into the potential challenges associated with obtaining and utilizing the document and propose effective resolutions for navigating these obstacles.

Minnesota Certificate of Rent Paid

The detailed examination underscores the critical role of the document in Minnesota’s property tax relief framework for renters. Accuracy, timeliness, and adherence to state regulations are paramount for its effective utilization. Understanding the eligibility requirements, rent reporting responsibilities, and filing deadlines are essential for both renters and landlords to navigate the process successfully.

Continued vigilance and proactive engagement with the requirements surrounding the Minnesota Certificate of Rent Paid are vital for ensuring equitable distribution of property tax relief and maintaining the integrity of the system. Stakeholders are encouraged to remain informed of any legislative updates or procedural changes impacting the program, thereby promoting a fair and transparent rental housing environment within the state.