A formal record of an individual’s passing is often required by various entities. This documentation serves as legal proof of death, triggering processes related to estate settlement, insurance claims, and other administrative procedures. Entities requiring such proof might include government agencies, financial institutions, and legal representatives. For example, before distributing assets from a deceased person’s bank account, the bank will typically demand this documentation.

The importance of officially registering a death lies in its multifaceted utility. This legal record enables the proper handling of the deceased’s assets and liabilities, prevents potential fraud, and facilitates statistical tracking of mortality rates for public health purposes. Historically, the formal recording of death evolved to ensure orderly inheritance and to protect the rights of surviving family members. Without a standardized system, complexities and disputes in estate management could arise, undermining legal frameworks.

The subsequent sections of this article will elaborate on the specific individuals, organizations, and circumstances that necessitate the presentation of official death records. We will explore the roles of family members, executors, government bodies, and insurance companies in this process, detailing the steps involved in obtaining and utilizing this essential legal document.

1. Executors

Executors, appointed either in a will or by a court, bear the primary responsibility for managing a deceased person’s estate. Their duties inherently necessitate obtaining and distributing official death records to various entities. This obligation stems from their legal mandate to settle the estate’s affairs according to the deceased’s wishes and the law.

-

Asset Inventory and Distribution

Executors must accurately identify and value all assets belonging to the estate. This process requires submitting official death records to financial institutions, such as banks and investment firms, to gain access to accounts and transfer ownership. Without a valid death record, these institutions are legally restricted from releasing information or transferring assets, hindering the executor’s ability to distribute them to beneficiaries.

Suggested read: Rare & Valuable Silver Certificates: Values & Guide

-

Debt Settlement

An executor is responsible for settling outstanding debts and liabilities of the deceased. Creditors, including mortgage companies, credit card issuers, and utility providers, require official death records to verify the death and initiate the claims process against the estate. Failure to provide this documentation can delay or complicate the debt settlement process, potentially leading to legal challenges.

-

Legal Proceedings and Probate

The executor initiates probate proceedings in the appropriate court to validate the will (if one exists) and legally transfer assets to the beneficiaries. The death record is a fundamental document required by the court to open the probate case and establish the executor’s authority to act on behalf of the estate. Its absence would prevent the formal legal process from commencing.

-

Tax Filings

Executors are responsible for filing final income tax returns for the deceased and, if applicable, estate tax returns. The death record is often required as supporting documentation for these filings, particularly when claiming certain deductions or exemptions related to the death. Furthermore, the date of death specified on the official record is crucial for determining tax deadlines and valuation dates.

In summary, the executor’s role as the central administrator of the estate inextricably links them to the widespread need for official death records. Their ability to fulfill their duties, from asset management to legal compliance, hinges on the proper acquisition and distribution of this essential document.

2. Courts

The judicial system’s engagement with official records confirming an individual’s demise is integral to several legal processes. Courts often require these documents as foundational evidence in matters concerning probate, estate administration, and dependency claims. The presentation of such a record directly triggers specific judicial actions, serving as legal validation of a material event that alters legal standing and obligations. For instance, in probate proceedings, the absence of this primary document prevents the court from formally recognizing the transfer of assets, causing delays and potentially hindering the lawful distribution of the deceased’s property to rightful heirs. Dependency claims, particularly those involving minors or incapacitated adults, necessitate verifiable proof of a caregiver’s passing to initiate reassignment of guardianship or access to survivor benefits.

Suggested read: Get Free Mental Health Training + Certificates

Consider the scenario of a contested will. The court’s ability to adjudicate the validity of the document and oversee the lawful transfer of assets hinges on establishing that the testator is deceased. A certified death record provides unequivocal evidence, enabling the court to proceed with due diligence and uphold the principles of fairness and legal integrity. Furthermore, in instances where wrongful death lawsuits are pursued, the record serves as critical supporting documentation, establishing the fact of death and its correlation to alleged negligent or intentional actions. This allows the court to assess liability and determine appropriate compensation for surviving family members. The record ensures transparency and accountability within the judicial process.

In summation, official death records function as essential evidentiary components within the judicial framework, enabling courts to execute their mandated functions in matters pertaining to estate settlement, guardianship, and legal claims. Challenges may arise when records are incomplete, contested, or unavailable, potentially leading to protracted legal battles and uncertainty. Understanding the significance of these records within the court system is critical for legal professionals, estate administrators, and individuals navigating the complexities of post-mortem legal proceedings.

3. Insurance companies

Insurance companies form a crucial link in the chain of entities requiring official death records. Their need stems from their role in administering life insurance policies and other death-related benefits, making them key stakeholders in the validation process following an individual’s passing.

-

Life Insurance Claims Processing

The primary function necessitating death records for insurance companies is the processing of life insurance claims. To initiate a payout to beneficiaries, insurers require irrefutable proof of the insured’s death. The official death record serves as this verification, preventing fraudulent claims and ensuring that benefits are disbursed to the rightful recipients according to the policy terms. Without this document, the claim cannot proceed, leading to delays and potential legal complications.

-

Policy Validation and Fraud Prevention

Insurance companies utilize death records not only for claim payouts but also to validate the legitimacy of existing policies. Upon receiving notification of an insured’s death, the company cross-references the information against its records to confirm the policy’s validity and identify any potential discrepancies or fraudulent activity. This process safeguards against individuals attempting to claim benefits on policies obtained through misrepresentation or other illegal means.

-

Annuity and Pension Benefit Adjustments

Suggested read: Get Your NM Death Certificate Fast & Easy

Death records are essential for adjusting annuity and pension benefits tied to an individual’s life. Upon the policyholder’s death, the insurer needs official documentation to terminate payments or transfer benefits to surviving beneficiaries, as outlined in the annuity or pension agreement. The record ensures accurate calculation and disbursement of benefits, complying with contractual obligations and legal requirements.

-

Risk Assessment and Actuarial Analysis

Beyond individual claim processing, death records contribute to broader risk assessment and actuarial analysis within the insurance industry. By aggregating mortality data from official records, insurance companies can refine their risk models, adjust premiums, and develop new insurance products. This data-driven approach enables insurers to manage their liabilities effectively and offer competitive products based on accurate mortality predictions.

In conclusion, insurance companies’ reliance on official death records extends beyond simple claim payouts. These records are fundamental to validating policies, preventing fraud, adjusting benefits, and informing actuarial science. Their use underscores the critical role these documents play in maintaining the integrity and stability of the insurance industry.

4. Banks

Banks require official death records to initiate specific procedures related to the deceased’s accounts. This requirement stems from their legal obligation to protect assets and ensure proper transfer of funds according to applicable laws and regulations. A death record serves as irrefutable evidence of the account holder’s passing, triggering a chain of actions that includes freezing accounts, verifying beneficiaries, and ultimately, releasing funds to the appropriate parties. For example, upon notification of a client’s death, a bank will typically place a hold on all accounts held solely in the deceased’s name until a death record is presented. This prevents unauthorized access or fraudulent withdrawals. The bank then uses the document to verify the identity of the executor or administrator of the estate, who is legally authorized to manage the deceased’s financial affairs. Without this formal proof, banks face significant legal risks and cannot proceed with estate settlement.

The practical application of this process extends beyond individual account management. Banks often hold assets in trust for individuals or manage investments on their behalf. In these cases, a death record is necessary to adjust the terms of the trust, reallocate investment portfolios, or distribute proceeds to beneficiaries. The timing of these actions can have significant financial implications for the estate and its heirs. Furthermore, banks may also be creditors of the deceased, holding mortgages, loans, or credit card debts. In such instances, a death record is required to initiate claims against the estate for outstanding balances. The accurate and timely submission of the document is thus crucial for both settling debts and releasing assets. Failure to provide a valid death record can result in delays in accessing funds, incurring additional fees, or facing legal challenges from creditors or beneficiaries.

In summary, banks’ requirement for official death records is a critical component of estate administration. This practice ensures legal compliance, protects assets, and facilitates the orderly transfer of funds to rightful heirs. Challenges often arise when death records are unavailable, incomplete, or contested, potentially causing significant delays and complications in the financial settlement process. Understanding the bank’s role and requirements is essential for executors, administrators, and family members navigating the complexities of post-mortem financial management.

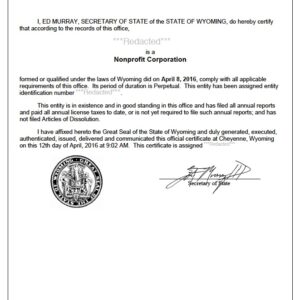

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

5. Government agencies

Government agencies represent a critical component of the framework requiring official documentation following an individual’s death. This necessity stems from their roles in vital statistics collection, benefits administration, and legal oversight. The requirement for official death records is not arbitrary; it is intrinsically linked to the agencies’ mandates for accurate record-keeping, prevention of fraud, and proper allocation of public resources. For instance, the Social Security Administration mandates submission of a death certificate to terminate benefit payments to the deceased and potentially initiate survivor benefits for eligible dependents. This prevents erroneous or fraudulent payments, ensuring responsible stewardship of taxpayer funds. Similarly, state Departments of Motor Vehicles require death certificates to revoke driver’s licenses and update their records, preventing identity theft and misuse of deceased individuals’ identities.

Furthermore, agencies such as the Department of Veterans Affairs utilize death records to determine eligibility for survivor benefits for spouses and dependents of deceased veterans. The accuracy and timeliness of death record submission directly impact the delivery of these benefits, providing crucial financial support to grieving families. At a broader level, public health agencies rely on mortality data derived from death records to track disease patterns, monitor public health trends, and develop effective intervention strategies. This data informs policy decisions related to healthcare resource allocation, disease prevention programs, and emergency preparedness planning. The Centers for Disease Control and Prevention (CDC), for example, utilizes mortality data to compile national statistics on causes of death, informing public health initiatives aimed at reducing preventable deaths.

In summary, the involvement of government agencies in the requirement for official death records is essential for maintaining accurate records, preventing fraud, administering benefits, and informing public health policies. The implications of incomplete or inaccurate death records extend beyond individual cases, impacting the integrity of government programs and the effectiveness of public health initiatives. Understanding the specific requirements and procedures of various government agencies is crucial for executors, family members, and legal professionals involved in settling an estate. Proper compliance ensures that benefits are disbursed appropriately, fraud is prevented, and public health data remains reliable.

6. Pension providers

Pension providers, both public and private entities, feature prominently among those requiring official confirmation of death. This requirement is rooted in their contractual obligations to manage and distribute pension benefits in accordance with legal and policy frameworks. Accurate verification of death is paramount for ensuring the proper cessation of payments to the deceased and, where applicable, the commencement of survivor benefits.

-

Cessation of Payments

Upon the death of a pension recipient, providers are legally obligated to cease benefit payments to the deceased individual. The official death record serves as the definitive proof necessary to initiate this action. Without this documentation, the provider risks continuing payments in error, potentially leading to financial mismanagement and legal repercussions. For instance, a private pension fund cannot simply rely on hearsay or unofficial sources to terminate benefits; a certified death certificate is a prerequisite.

-

Survivor Benefits Eligibility

Many pension plans include provisions for survivor benefits, offering financial support to spouses or other eligible dependents following the death of the primary beneficiary. Accessing these benefits hinges on providing the pension provider with an official death record. This document substantiates the death and allows the provider to verify the survivor’s eligibility based on the plan’s specific terms and conditions. Consider a scenario where a widow seeks to claim survivor benefits from her deceased husband’s government pension; the death certificate is essential evidence for establishing her claim.

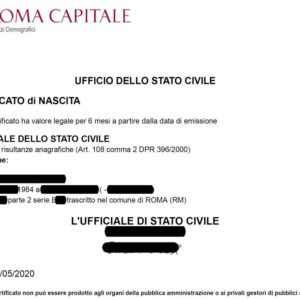

Suggested read: Email for Italian Birth Certificate? Get it Now!

-

Actuarial Accuracy and Fund Management

Pension providers rely on accurate mortality data for actuarial calculations and long-term fund management. Official death records contribute significantly to this data pool, enabling providers to refine their mortality assumptions and ensure the financial sustainability of their plans. By tracking mortality rates and patterns, pension funds can more effectively manage their liabilities and meet their future obligations. For example, a large public pension system will utilize aggregated death record data to project future benefit payouts and adjust contribution rates accordingly.

-

Legal and Regulatory Compliance

Pension providers operate within a complex legal and regulatory environment. Compliance with these regulations often mandates the collection and verification of death information. Failure to adhere to these requirements can result in penalties, legal challenges, and reputational damage. Government oversight bodies, such as pension regulatory authorities, routinely audit pension funds to ensure they are adhering to proper procedures for verifying death and distributing benefits. A demonstrable paper trail, including official death records, is crucial for demonstrating compliance.

The outlined facets demonstrate that the requirement for official death records by pension providers is multifaceted. It is not merely a bureaucratic formality but a critical component of responsible financial management, legal compliance, and the equitable distribution of pension benefits. The reliance on verifiable documentation ensures the integrity of pension systems and protects the rights of both deceased beneficiaries and their surviving dependents.

Frequently Asked Questions Regarding Official Death Record Requirements

This section addresses common inquiries regarding the necessity of providing official documentation confirming a person’s death. The responses aim to clarify the roles of various entities requiring this documentation and the rationale behind these requirements.

Question 1: Why is an official death record required instead of other forms of proof?

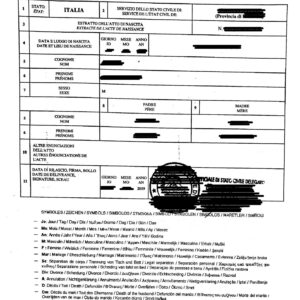

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

An official death record is a legally recognized document issued by a government authority. It provides definitive proof of death, ensuring accuracy and preventing fraudulent claims. Other forms of proof, such as obituaries or informal notifications, lack the legal standing and verification mechanisms necessary for financial and legal processes.

Question 2: What happens if an official death record is unavailable?

If an official death record is unavailable due to extraordinary circumstances (e.g., death occurring in a foreign country with unreliable record-keeping), alternative forms of documentation, such as a consular report of death abroad or a court order declaring death, may be accepted by certain entities. However, acceptance is not guaranteed, and legal consultation is advisable.

Question 3: Who is responsible for obtaining an official death record?

The responsibility for obtaining an official death record typically falls to the next of kin or the executor/administrator of the deceased’s estate. Funeral homes often assist in this process, but the ultimate responsibility rests with the family or the estate representative.

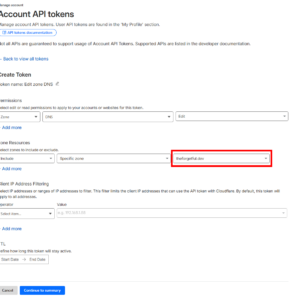

Suggested read: Unraid Certificate Location: Find & Manage Your Provision

Question 4: How many copies of the official death record are typically needed?

The number of copies needed varies depending on the complexity of the estate and the number of entities requiring documentation. It is advisable to obtain multiple certified copies to avoid delays in settling the estate, as many institutions require original documents rather than photocopies.

Question 5: Can a digital copy of an official death record be used instead of a physical copy?

The acceptability of digital copies varies depending on the specific entity. While some institutions may accept certified digital copies obtained directly from the issuing authority, others require physical, certified copies with raised seals. It is crucial to verify the requirements with each individual entity.

Question 6: What are the potential consequences of failing to provide an official death record when required?

Suggested read: CPT Certification: What It Is & Why It Matters

Failure to provide an official death record can result in significant delays in accessing funds, settling debts, claiming benefits, and finalizing legal processes. It may also lead to legal challenges from creditors or beneficiaries, as well as potential penalties for non-compliance.

In summary, the proper acquisition and distribution of official death records are essential for ensuring the orderly and legally sound management of a deceased person’s affairs. Understanding the specific requirements of various entities and adhering to established procedures is crucial for avoiding complications and protecting the interests of the estate and its beneficiaries.

The following section will provide resources and guidance on navigating the process of obtaining and utilizing official death records.

Navigating Official Death Record Requirements

The proper handling of official death records is crucial for efficiently managing a deceased individual’s affairs. The following tips offer guidance for navigating the process, ensuring compliance, and minimizing potential complications.

Tip 1: Obtain Multiple Certified Copies: Secure several certified copies of the death record from the issuing authority. Financial institutions, government agencies, and legal entities typically require original certified copies, not photocopies. Anticipate needing more copies than initially estimated to avoid delays.

Tip 2: Prioritize Timeliness: Initiate the process of obtaining the death record promptly after the individual’s passing. Delays in obtaining this document can impede estate settlement, insurance claims, and access to benefits. Contact the relevant vital records office or funeral home as soon as possible.

Tip 3: Maintain Accurate Records: Keep meticulous records of where each death record copy is sent and the corresponding dates. This documentation aids in tracking progress and resolving potential discrepancies or lost documents. Create a spreadsheet or dedicated file to organize this information.

Tip 4: Understand Institutional Requirements: Verify the specific requirements of each institution (e.g., banks, insurance companies, government agencies) regarding death record submission. Some entities may have unique forms or procedures that must be followed to ensure proper processing.

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

Tip 5: Safeguard the Original Documents: Treat official death records as valuable legal documents. Store them in a secure location, such as a safe deposit box or locked filing cabinet, to prevent loss, theft, or damage. Consider creating high-quality digital scans for backup purposes, but always prioritize the physical originals.

Tip 6: Consult with Legal Counsel: If complexities arise during the estate settlement process, seek guidance from an experienced estate attorney. Legal counsel can provide valuable assistance in navigating legal requirements, resolving disputes, and ensuring compliance with applicable laws.

Tip 7: Prepare for Potential Delays: Be aware that processing times for obtaining death records and settling estates can vary. Factors such as backlogs at vital records offices or complexities in the estate’s assets can contribute to delays. Patience and proactive communication with relevant entities are essential.

These tips are intended to provide practical guidance for navigating the often-complex process of handling official death records. Adhering to these recommendations can streamline estate administration, minimize delays, and ensure compliance with legal and institutional requirements.

The following final section summarizes the core points discussed in this article, emphasizing the importance of understanding and fulfilling official death record requirements.

Conclusion

The preceding sections have elucidated the pervasive necessity of official death records across various sectors. Examination of the list of who needs death certificates reveals that government agencies, financial institutions, legal bodies, and insurance providers uniformly rely upon this documentation to initiate critical processes. The absence of official confirmation can significantly impede estate settlements, delay benefits disbursement, and potentially expose institutions to fraudulent activity. The systematic review of key stakeholders underscores the integral role death records play in maintaining legal and financial order following an individual’s passing.

Understanding these requirements is not merely a procedural formality but a crucial responsibility for executors, family members, and legal professionals. A proactive approach to acquiring and distributing official death records streamlines administrative processes and ensures timely fulfillment of obligations. Recognizing the significance of this document contributes to a more efficient and equitable resolution of post-mortem affairs, promoting clarity and minimizing potential legal and financial complications.