A document issued by the Florida Department of Revenue, this authorization permits businesses to purchase or rent taxable items for resale or re-rental without paying sales tax. For instance, a retail store buying inventory for sale to customers would utilize this certificate to avoid paying sales tax on the initial purchase from its supplier.

The primary benefit lies in enabling businesses to manage cash flow more effectively. By deferring the sales tax payment until the point of sale to the end consumer, businesses retain capital for operational expenses and growth. The authorization streamlines the sales tax collection process and ensures compliance with Florida tax laws. Historically, it represents a significant step in facilitating commerce within the state by preventing the cascading effect of sales tax on business inputs.

The following sections will delve into the application process, renewal requirements, acceptable uses, and potential penalties associated with improper utilization of this essential document. Further clarification will also be provided regarding record-keeping obligations and frequently asked questions pertaining to its application and maintenance.

1. Application Requirements

The acquisition of the authorization is contingent upon meeting specific criteria established by the Florida Department of Revenue. These requirements are designed to verify the legitimacy of the applicant’s business and ensure compliance with state tax regulations. The fulfillment of these requirements is not merely procedural but is a fundamental prerequisite for lawful operation and tax collection within Florida.

-

Valid Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

A valid FEIN, for businesses, or SSN, for sole proprietorships, is mandatory. This identifier allows the Department of Revenue to accurately track business activity and tax liabilities. The absence of a valid identifier will automatically disqualify an application, highlighting the importance of proper business registration and accurate documentation.

-

Active Business Registration with the Florida Department of State

Suggested read: Get Your SC Resale Certificate: Guide & Apply Today

The applicant must demonstrate an active business registration, indicating legal establishment and authorization to conduct business within Florida. This registration confirms that the business is in good standing and adheres to all applicable state regulations. Failure to maintain an active registration can result in the denial or revocation of the authorization.

-

Principal Business Activity Description

A detailed description of the principal business activity is required to determine eligibility. This description must clearly articulate the nature of the business and its intended use of the document for resale purposes. Ambiguous or misleading descriptions can lead to application rejection or subsequent audits to verify the legitimacy of the business’s claims.

-

Physical Business Address in Florida

A verifiable physical business address located within Florida is a necessity. This address serves as the primary point of contact for official communications and potential audits by the Department of Revenue. A Post Office Box alone is generally insufficient, emphasizing the need for a legitimate operational location within the state.

Successfully navigating these requirements is paramount to obtaining the needed authority to purchase inventory for resale without incurring sales tax upfront. Meeting these stipulations not only secures the document but also lays the foundation for sustained compliance and successful participation in the Florida business ecosystem. Failure to meet any of these stipulations could result in denial of the application.

2. Renewal Frequency

The continued validity of this authorization hinges on strict adherence to the established renewal frequency. Specifically, it necessitates an annual renewal process. Failure to comply with this annual requirement results in expiration of the certificate, thereby rendering the holder liable for sales tax on all purchases made for resale. This annual cycle ensures that the Florida Department of Revenue maintains an updated registry of businesses legitimately engaged in resale activities.

The annual renewal mandates that businesses proactively verify and update their information with the Department of Revenue. This includes confirming the accuracy of their business name, address, Federal Employer Identification Number (FEIN), and principal business activity. A delay or omission in the renewal process, whether intentional or unintentional, can lead to operational disruptions, as suppliers may refuse to honor expired certificates. For instance, a retail store with an expired certificate might be required to pay sales tax on a large inventory order, impacting its profit margin and cash flow until the certificate is reinstated. This highlights the practical significance of a well-managed renewal process.

Suggested read: Get Your Louisiana Resale Certificate Fast & Easy

In summary, the annual renewal cycle serves as a crucial mechanism for maintaining the integrity of the Florida resale certificate system. While the renewal frequency ensures that information remains current and accurate, it also places a responsibility on businesses to diligently manage their renewal timelines. Adherence to this requirement avoids potential financial penalties and maintains uninterrupted access to the benefits afforded by this certificate, ultimately contributing to the smooth operation of Florida’s business landscape.

3. Permitted Purchases

The scope of authorized purchases under a Florida resale certificate is explicitly defined and restricted to items intended for resale or re-rental. This delineation is critical; unauthorized usage can lead to penalties and revocation of the certificate.

-

Tangible Personal Property for Resale

The primary permitted purchase encompasses tangible personal property that the certificate holder intends to resell in its ordinary course of business. For example, a clothing retailer can use the certificate to purchase apparel from a wholesaler without paying sales tax, provided the retailer will subsequently sell the clothing to consumers. If the retailer were to use the same certificate to purchase office supplies, this would be an unauthorized use, as the supplies are not for resale.

-

Items Incorporated into a Product for Resale

The certificate extends to components that are incorporated into a product for resale. A manufacturer of furniture can utilize the certificate to acquire raw materials like wood and fabric without incurring sales tax. The understanding is that these materials will become part of a finished piece of furniture that will then be sold to a customer. Direct use of a certificate to buy items not incorporated into the furniture would constitute a misuse.

-

Rental Items for Re-rental

Businesses engaged in the rental or leasing of tangible personal property may employ the certificate to acquire items for re-rental. For instance, a car rental agency can use the certificate to purchase vehicles intended for its rental fleet. This differs significantly from purchasing vehicles for internal use, such as employee transportation, which would not be covered under the resale certificate.

-

Certain Services Directly Related to Resale Activities

Suggested read: IN Resale Certificate: Easy Guide + Apply Now!

In specific instances, particular services directly tied to resale activities may also qualify for tax exemption under the certificate. This could include services such as alterations to clothing being resold or refurbishment of rental equipment. However, the nexus between the service and the resale activity must be clearly demonstrable. General maintenance services for a business premises, for example, would not fall under this exemption.

Understanding these parameters is paramount for businesses operating with a Florida resale certificate. Adherence to these guidelines not only ensures compliance but also optimizes cash flow by avoiding unnecessary tax payments on eligible purchases. Strict interpretation and enforcement by the Florida Department of Revenue make it essential for certificate holders to maintain meticulous records and seek clarification when uncertainty arises regarding the eligibility of specific purchases.

4. Record-keeping obligations

Maintaining meticulous records is not merely advisable, but an absolute necessity for businesses operating with a Florida resale certificate. These obligations serve as the cornerstone of compliance and are subject to rigorous scrutiny by the Florida Department of Revenue. Failure to uphold these record-keeping standards can result in penalties, revocation of the certificate, and potential legal repercussions.

-

Maintenance of Sales Invoices

Businesses must retain detailed records of all sales transactions, including invoices that clearly identify the items sold, the date of sale, the selling price, and the amount of sales tax collected (if applicable). These invoices serve as primary documentation for demonstrating that sales tax has been properly collected and remitted to the state. In the context of the certificate, these invoices are crucial in differentiating between taxable retail sales and tax-exempt sales to other businesses using their own valid certificates.

-

Retention of Purchase Invoices Showing Certificate Use

Businesses must retain copies of all purchase invoices where the resale certificate was used to avoid paying sales tax. These invoices must clearly indicate the certificate number and demonstrate that the purchased items were indeed intended for resale or re-rental. The absence of these purchase invoices raises suspicion regarding the legitimacy of the tax exemption and could trigger an audit by the Department of Revenue.

-

Documentation of Exemption Certificates Received

Suggested read: Get Your FL Temporary Teaching Certificate Fast!

When selling to other businesses claiming a sales tax exemption with their own resale certificates or other exemption documentation, the seller must retain copies of these certificates. This documentation substantiates the seller’s claim that the sale was legitimately exempt from sales tax. Without these certificates, the seller may be held liable for the uncollected sales tax, even if the buyer misrepresented their exemption status.

-

Maintenance of Records for a Minimum of Three Years

All records pertaining to sales, purchases, and exemption certificates must be retained for a minimum of three years from the date of the transaction. This retention period aligns with the statute of limitations for tax assessments in Florida. Failure to produce these records upon request during an audit can lead to the assessment of back taxes, penalties, and interest charges, even if the business genuinely believed it was operating in compliance.

The proper fulfillment of record-keeping obligations is not merely a bureaucratic exercise, but a fundamental component of responsible business management in Florida. These requirements are designed to protect the integrity of the state’s tax system and ensure that all businesses contribute their fair share. Businesses must understand the significance of these obligations and implement robust record-keeping practices to avoid the potentially severe consequences of non-compliance with “florida annual resale certificate” regulations.

5. Revocation Conditions

The validity of a Florida resale certificate is not indefinite; it is contingent upon adherence to specific regulations and can be revoked under certain conditions. These revocation conditions are not arbitrary but are designed to protect the state’s tax revenue and ensure fair business practices. Understanding these conditions is crucial for businesses operating with a Florida resale certificate, as revocation carries significant implications.

Misuse of the certificate is a primary cause for revocation. This includes, but is not limited to, using the certificate to purchase items for personal use, purchasing items that are not intended for resale or re-rental, or allowing unauthorized individuals to use the certificate. For example, a hardware store owner who uses the businesss resale certificate to purchase materials for a personal home renovation project is in direct violation of the certificate’s terms. Similarly, a business that knowingly provides its certificate to a friend or family member for unauthorized purchases is subject to revocation. The Department of Revenue actively monitors certificate usage through audits and data analysis, increasing the likelihood of detection and subsequent penalties. Maintaining meticulous records of all purchases, as previously discussed, is essential to demonstrate compliance and mitigate the risk of revocation.

Further grounds for revocation include failure to file sales tax returns, failure to remit sales tax collected from customers, and engaging in fraudulent activity. Non-compliance with these fundamental tax obligations directly undermines the integrity of the state’s revenue system and warrants immediate revocation of the resale certificate. A business that consistently fails to file its monthly or quarterly sales tax returns, even if no sales tax is due, demonstrates a disregard for its tax responsibilities, making it a prime candidate for certificate revocation. Revocation is not merely a punitive measure but a necessary safeguard to maintain fair competition and prevent tax evasion. By understanding and adhering to the conditions that can lead to revocation, businesses can protect their right to operate with a Florida resale certificate and contribute to a more equitable business environment.

6. Taxable sales

The Florida resale certificate directly influences the determination of taxable sales for businesses. The certificate allows a business to purchase goods intended for resale without paying sales tax at the time of purchase. However, when that business subsequently sells those goods to an end consumer, that transaction constitutes a taxable sale, and the business is responsible for collecting and remitting sales tax to the Florida Department of Revenue. Failure to collect sales tax on taxable sales, even if the business possesses a valid resale certificate, results in non-compliance and potential penalties. For instance, a furniture store that purchases sofas using a resale certificate must collect sales tax when it sells those sofas to customers. The store’s use of the resale certificate does not absolve it of the responsibility to collect and remit sales tax on the final sale.

The interplay between the resale certificate and taxable sales necessitates meticulous record-keeping. Businesses must clearly distinguish between purchases made for resale (exempt from sales tax at the time of purchase) and final sales to consumers (subject to sales tax). Proper accounting systems are essential to track sales tax liabilities accurately. Consider a scenario where a clothing retailer purchases inventory using a resale certificate but then donates a portion of that inventory to a charity. The donation is not a taxable sale, but it also does not qualify for the resale exemption, potentially triggering a use tax obligation. The retailer must accurately document the donation to avoid inadvertently underreporting its tax liabilities.

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

Ultimately, the Florida resale certificate provides a mechanism for businesses to manage their cash flow by deferring sales tax payments. However, it does not eliminate the obligation to collect and remit sales tax on taxable sales. A clear understanding of what constitutes a taxable sale, coupled with diligent record-keeping practices, is paramount for businesses to comply with Florida tax laws. The consequence of misinterpreting the relationship between the resale certificate and taxable sales can range from minor penalties to significant financial liabilities and revocation of the certificate itself. Therefore, businesses must prioritize accurate sales tax collection and reporting to maintain compliance and avoid potential repercussions.

Frequently Asked Questions about the Florida Annual Resale Certificate

This section addresses common inquiries regarding the Florida Annual Resale Certificate, providing clarity on its application, usage, and compliance requirements.

Question 1: Who is eligible to obtain a Florida Annual Resale Certificate?

Any business engaged in the sale or rental of tangible personal property in Florida, and registered with the Florida Department of Revenue, may apply for a Florida Annual Resale Certificate. Eligibility is contingent upon demonstrating a legitimate business purpose for purchasing items for resale or re-rental.

Question 2: What are the permissible uses of the Florida Annual Resale Certificate?

The certificate solely authorizes the purchase or rental of tangible personal property that will be resold or re-rented. It cannot be used to acquire items for personal use, or items consumed in the business operation (e.g., office supplies). Misuse may result in penalties and revocation.

Suggested read: Email for Italian Birth Certificate? Get it Now!

Question 3: How frequently must the Florida Annual Resale Certificate be renewed?

The certificate must be renewed annually. Failure to renew within the prescribed timeframe will result in the certificate’s expiration, rendering the holder liable for sales tax on all purchases intended for resale until the certificate is reinstated.

Question 4: What records must be maintained when utilizing the Florida Annual Resale Certificate?

Businesses are obligated to maintain detailed records of all purchases made using the certificate, as well as sales invoices documenting the subsequent resale of those items. These records must be retained for a minimum of three years and be readily available for inspection by the Florida Department of Revenue.

Question 5: What are the potential consequences of misusing a Florida Annual Resale Certificate?

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

Misuse of the certificate can lead to a range of penalties, including assessments for unpaid sales tax, fines, and potential criminal charges. The certificate may also be revoked, preventing the business from making tax-exempt purchases for resale in the future.

Question 6: If a supplier refuses to accept a Florida Annual Resale Certificate, what recourse is available?

Suppliers are obligated to accept a valid Florida Annual Resale Certificate presented by a registered business. Should a supplier refuse, the purchaser may file a complaint with the Florida Department of Revenue. The purchaser may also pay the sales tax and seek a refund from the Department of Revenue upon providing adequate documentation.

Understanding the regulations surrounding the Florida Annual Resale Certificate is crucial for compliant operation in Florida’s business environment. Strict adherence to these regulations and meticulous record-keeping practices are essential.

This concludes the Frequently Asked Questions section. The following section will explore advanced strategies for optimizing the use of this important document within your business.

Optimizing the Use of the Florida Annual Resale Certificate

The following tips provide guidance on maximizing the benefits and minimizing the risks associated with the Florida Annual Resale Certificate. Adherence to these suggestions can improve operational efficiency and ensure continued compliance.

Tip 1: Implement a Robust Verification System

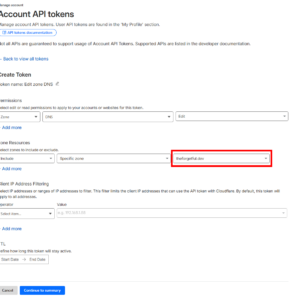

Before accepting a resale certificate from a customer, verify its validity through the Florida Department of Revenue’s online system. This practice mitigates the risk of accepting fraudulent or expired certificates, protecting against potential tax liabilities.

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

Tip 2: Conduct Regular Internal Audits

Periodically review purchase and sales records to ensure that the resale certificate is being used appropriately. These audits should focus on identifying any instances of misuse or discrepancies, allowing for corrective action before a state audit.

Tip 3: Train Employees on Proper Certificate Usage

Provide comprehensive training to all employees involved in purchasing and sales transactions regarding the appropriate use of the resale certificate. This training should cover acceptable purchases, verification procedures, and record-keeping requirements.

Tip 4: Maintain Detailed and Organized Records

Implement a system for storing and organizing all purchase invoices, sales invoices, and resale certificates received. These records should be easily accessible and well-maintained to facilitate audits and ensure compliance.

Tip 5: Establish a Renewal Reminder System

Create a system to track the expiration date of the Florida Annual Resale Certificate and ensure timely renewal. This system should include multiple reminders to prevent inadvertent expiration and associated tax liabilities.

Suggested read: Free Volunteer Certificate: Get Yours Now!

Tip 6: Seek Professional Guidance When Uncertain

When faced with complex transactions or unclear scenarios, consult with a qualified tax professional or the Florida Department of Revenue for guidance. Proactive consultation can prevent costly errors and ensure compliance.

Tip 7: Understand the Definition of “Tangible Personal Property”

A thorough understanding of what constitutes tangible personal property under Florida law is essential for determining whether an item is eligible for purchase using the resale certificate. Misclassifying an item can lead to misuse and potential penalties.

By implementing these strategies, businesses can optimize the benefits of the Florida Annual Resale Certificate, minimize the risk of non-compliance, and foster a more efficient and fiscally responsible operation.

These tips provide a practical framework for leveraging the benefits associated with this document. The following section provides a comprehensive conclusion to the article.

Conclusion

This exploration has illuminated the multifaceted aspects of the Florida Annual Resale Certificate, emphasizing its critical role in facilitating commerce within the state. The document’s proper application, consistent renewal, and adherence to permitted purchase guidelines are essential for maintaining compliance and maximizing its benefits. The strict record-keeping obligations, as well as the implications of revocation conditions, necessitate a diligent approach to certificate management.

The responsible utilization of the Florida Annual Resale Certificate is not merely a matter of procedural compliance but a reflection of a business’s commitment to ethical and lawful operations. Businesses are therefore encouraged to continuously educate themselves on the evolving regulations surrounding this essential instrument and to seek professional guidance when uncertainty arises. By prioritizing compliance and fostering a culture of responsible tax management, businesses contribute to the integrity of Florida’s economic ecosystem.