A type of deposit agreement with a fixed maturity date and interest rate, issued by a bank, that can be transferred to another party before its maturity is a financial instrument widely utilized in money markets. Ownership of this instrument is transferable via endorsement and delivery, enabling it to be bought and sold in the secondary market. For example, a corporation with surplus cash might purchase this instrument to earn a return until it needs the funds for operational expenses.

The ability to transfer ownership provides significant liquidity, making it attractive to investors seeking short-term, low-risk investments. Historically, these instruments emerged as a means for banks to attract large deposits and manage their funding needs more effectively. The market for these instruments contributes to the overall efficiency of the financial system by providing a mechanism for efficient allocation of capital among different entities.

Having established a foundational understanding, the following sections will delve into the specific characteristics of this instrument, its role in portfolio management, and the risks associated with its use. Furthermore, the discussion will extend to an examination of regulatory considerations and the prevailing market trends influencing its yield and availability.

1. Transferable ownership

The characteristic of transferable ownership is inextricably linked to the essence of a negotiable certificate of deposit and defines its place within money market instruments. It is the pivotal feature distinguishing it from standard, non-negotiable certificates of deposit. Because ownership of these instruments can be transferred through endorsement and delivery, a secondary market is established where investors can buy and sell them before their maturity date. This transferability creates liquidity for investors and allows them to manage their short-term cash needs effectively. For example, a corporation holding these instruments can sell them on the secondary market if it encounters an unforeseen expense before the certificates mature, rather than being locked into the investment until maturity.

The presence of transferable ownership directly affects the instrument’s pricing and yield. Increased liquidity, derived from the ability to trade the certificate, generally reduces the risk premium demanded by investors, leading to slightly lower yields compared to less liquid investments. The efficiency of the secondary market, facilitated by this transferability, also allows for more accurate price discovery, reflecting the prevailing market interest rates and creditworthiness of the issuing bank. Regulations governing the transfer process, endorsement requirements, and settlement procedures are critical for maintaining the integrity and smooth functioning of this market.

In summary, transferable ownership is not merely an ancillary feature; it is a fundamental element that dictates the functionality and value proposition of these instruments. It provides liquidity, influences pricing dynamics, and supports the overall efficiency of the money market. Understanding the legal framework governing the transfer of these instruments is crucial for all participants, from issuers to investors, in effectively managing their short-term financial assets and liabilities.

2. Fixed maturity

Fixed maturity, as it relates to these instruments, is a predetermined date upon which the principal amount, along with accrued interest, becomes payable to the holder. This defined timeframe is an integral element in their structure, influencing both investor strategy and issuer liability. The existence of a specified maturity allows investors to align these investments with their short-term cash flow needs and liability management objectives. For instance, a treasurer managing a corporate cash reserve might purchase these instruments with a maturity date coinciding with a projected tax payment, thereby ensuring funds are available when required. The issuer, typically a bank, benefits from a predictable funding horizon, allowing for better asset-liability matching within its balance sheet.

Suggested read: What is a Physician Emergency Certificate? [Definition]

The length of the fixed maturity period influences the yield offered on these instruments. Generally, longer maturities command higher yields to compensate investors for the increased interest rate risk and potential illiquidity they face. However, the differential between short and long-term maturity yields also reflects broader macroeconomic conditions and market expectations regarding future interest rate movements. The precise fixed maturity also determines the instrument’s role within various investment portfolios. Short-dated maturities often serve as a substitute for cash or highly liquid government securities, while longer-dated maturities may be utilized in strategies seeking to enhance yield within a conservative risk profile. The investor must carefully consider their investment horizon and risk tolerance when selecting the appropriate maturity.

In conclusion, the fixed maturity feature is not merely a technical detail but a fundamental characteristic shaping the purpose, pricing, and application of these instruments. It facilitates effective cash management for both issuers and investors by providing certainty regarding the timing of principal repayment. Understanding the interplay between fixed maturity, yield, and market conditions is essential for utilizing these instruments efficiently within a diversified investment strategy. Challenges arise in forecasting future interest rates, particularly for longer-dated maturities, necessitating careful analysis and risk management techniques.

3. Secondary Market

The secondary market is a crucial component in understanding the nature of these financial instruments. Its presence fundamentally alters their function and value, providing liquidity and influencing their pricing dynamics. The existence of an active secondary market is one of the defining characteristics differentiating negotiable certificates of deposit from their non-negotiable counterparts.

-

Liquidity Provision

The secondary market allows investors to sell their holdings before the maturity date, providing liquidity that would otherwise be absent. This liquidity enhances the attractiveness of these instruments, as investors are not locked into holding them until maturity. For example, a money market fund holding a substantial amount of these instruments can readily sell a portion of its holdings on the secondary market to meet unexpected redemption requests from its investors.

-

Price Discovery

The interaction of buyers and sellers in the secondary market establishes a market price for these instruments, reflecting the prevailing interest rate environment and the creditworthiness of the issuing bank. This price discovery mechanism provides valuable information to both issuers and investors, allowing them to assess the fair value of the instrument. If a bank’s credit rating is downgraded, the price of its certificates of deposit in the secondary market will likely decrease, reflecting the increased risk.

-

Market Efficiency

Suggested read: Get Your Wyoming Certificate of Good Standing Fast!

The secondary market contributes to the overall efficiency of the money market by facilitating the transfer of funds between investors. This efficient allocation of capital supports economic activity. Institutions seeking short-term investments can readily acquire these instruments in the secondary market, while those needing to liquidate their holdings can find willing buyers. This seamless transfer of ownership enhances market depth and reduces transaction costs.

-

Regulatory Oversight

The functioning of the secondary market is subject to regulatory oversight aimed at ensuring fair trading practices, preventing market manipulation, and protecting investors. Regulatory bodies monitor trading activity, enforce disclosure requirements, and set standards for market participants. These regulations are essential for maintaining the integrity and stability of the market. For instance, regulations might require market participants to report large trades to increase transparency and prevent insider trading.

In essence, the secondary market transforms these financial instruments from static, illiquid investments into dynamic, readily tradable assets. It provides liquidity, facilitates price discovery, promotes market efficiency, and is subject to regulatory oversight to ensure its proper functioning. These features are intrinsically linked to its definition and contribute significantly to their role within the broader financial system.

4. Bank-issued

The origin of these instruments with regulated financial institutions is foundational to their function and perceived risk profile. The inherent backing of a bank imbues them with a level of security and standardization crucial to their widespread acceptance in money markets. This connection between issuer and instrument has deep implications.

-

Creditworthiness Assessment

The creditworthiness of the issuing bank directly influences the yield and market demand for these instruments. Higher-rated banks are able to offer lower yields due to their perceived lower risk of default, attracting investors seeking stability. Conversely, banks with lower credit ratings must offer higher yields to compensate investors for the increased risk they assume. Credit rating agencies play a crucial role in assessing and communicating the creditworthiness of the issuing banks, directly impacting the perceived risk of the associated instruments. The failure of a bank often leads to substantial losses for those holding its liabilities, including negotiable certificates of deposit.

-

Regulatory Oversight and Insurance

Bank issuance subjects these instruments to stringent regulatory oversight by banking authorities. These regulations aim to ensure the stability of the banking system and protect depositors. In many jurisdictions, these instruments are covered by deposit insurance schemes, providing an additional layer of protection for investors, up to specified limits. The presence of deposit insurance mitigates the risk of loss in the event of a bank failure, enhancing the attractiveness of these instruments for risk-averse investors. However, deposit insurance coverage is typically limited, and investors holding large denominations of these instruments may still face losses in the event of a bank’s insolvency.

Suggested read: Email for Italian Birth Certificate? Get it Now!

-

Standardization and Marketability

The fact that these instruments are bank-issued contributes to their standardization, facilitating their trading in the secondary market. Banks adhere to certain standard practices and documentation requirements when issuing these instruments, which enhances their marketability. This standardization reduces transaction costs and promotes liquidity, making them attractive to a wider range of investors. Without standardization, it would be difficult to establish a robust secondary market, as investors would be hesitant to purchase instruments with unfamiliar or non-standard terms.

-

Impact on Bank Funding

The issuance of these instruments provides banks with a valuable source of short-term funding. Banks use the proceeds from the sale of these instruments to fund their lending activities and other operations. The ability to issue these instruments allows banks to manage their liquidity more effectively and respond to changes in demand for credit. Banks typically offer competitive interest rates on these instruments to attract investors, balancing the cost of funding with the need to maintain adequate liquidity. The volume of issued by banks can serve as an indicator of their funding needs and overall financial health. A significant increase in the issuance of these instruments may signal that a bank is facing liquidity challenges or is seeking to expand its lending operations.

In summary, the bank-issued nature of these instruments is deeply intertwined with their risk profile, marketability, and role in the broader financial system. The creditworthiness of the issuing bank, regulatory oversight, standardization, and impact on bank funding are all critical considerations for investors and regulators alike. These elements underscore the instrument’s position as a widely utilized tool for both short-term investment and bank liquidity management.

5. Large Denominations

The characteristic of large denominations is not merely an incidental attribute of these instruments, but rather a defining feature shaping their accessibility and intended market. This aspect significantly influences the types of investors who participate in this market and affects their overall function within the financial system.

-

Targeting Institutional Investors

The typically large denominations often starting at $100,000 and ranging into millions effectively preclude participation by individual retail investors. This concentration on institutional investors such as corporations, pension funds, and money market funds stems from the scale of funds managed by these entities. For example, a corporation with significant cash reserves might purchase these instruments to earn a return on surplus funds while maintaining liquidity. The large denominations align with the investment strategies of these entities and their capacity to absorb investments of this size.

Suggested read: Get Ancestor's Birth Certificate Italy: Who to Email + Tips

-

Reduced Transaction Costs

Issuing and trading financial instruments incur transaction costs. By concentrating trading in large denominations, issuers and market makers can reduce the per-unit cost of these transactions. For example, legal fees, administrative expenses, and brokerage commissions become relatively smaller when spread across a large principal amount. This efficiency makes them more attractive to both issuers and investors, promoting market activity. The economic rationale for large denominations lies in achieving economies of scale in the transaction process.

-

Wholesale Funding Mechanism

For banks, the use of large-denomination certificates of deposit represents a means of wholesale funding, allowing them to attract substantial deposits from institutional investors. This funding source complements retail deposits and provides a flexible way for banks to manage their liquidity and meet reserve requirements. For example, a bank might issue these instruments to fund specific lending activities or to bolster its capital base. The reliance on wholesale funding through these instruments reflects the sophistication of modern banking operations and the need to access diverse sources of funding.

-

Impact on Secondary Market Liquidity

While the large denominations initially restrict participation to institutional investors, they can also contribute to liquidity in the secondary market. These instruments often trade in round lots of significant size, facilitating efficient trading between large institutional participants. The presence of numerous entities with the capacity to trade in these large lots enhances market depth and reduces the potential for price volatility. Efficient trading is further encouraged by electronic trading platforms that allow for immediate execution of large transactions.

In summary, the large denomination requirement associated with these instruments is not an arbitrary characteristic. It reflects a strategic focus on institutional investors, the pursuit of reduced transaction costs, its role as a wholesale funding mechanism for banks, and the impact on secondary market liquidity. These factors are all intertwined and essential to understanding the instrument’s intended function and place within the broader financial landscape.

6. Interest bearing

The attribute of being “interest bearing” is a fundamental element in the definition of these instruments, serving as a primary incentive for investors and a key component in their valuation. It directly influences their attractiveness as a short-term investment vehicle and shapes the dynamics of their secondary market trading.

-

Determination of Yield

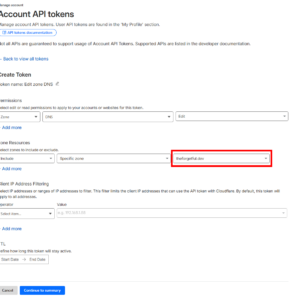

Suggested read: Unraid Certificate Location: Find & Manage Your Provision

The interest rate, whether fixed or variable, dictates the yield earned over the instrument’s term, directly affecting its appeal relative to alternative investments. The rate is determined by several factors, including the prevailing interest rate environment, the creditworthiness of the issuing bank, and the maturity date of the certificate. A higher interest rate generally attracts more investors, increasing demand and potentially affecting the instrument’s price in the secondary market. For example, if the Federal Reserve raises interest rates, newly issued instruments will likely offer higher yields, making older, lower-yielding instruments less attractive unless their price decreases.

-

Impact on Investment Decisions

The presence of interest earnings motivates investors to allocate capital to these instruments, particularly as a means of short-term cash management and liquidity enhancement. Corporations with excess cash may use these instruments to generate income while maintaining easy access to funds. Pension funds may use them to match short-term liabilities. The magnitude of the interest payment is a key consideration in the decision to invest, weighed against the risk of default and the opportunity cost of other potential investments. The rate must be competitive with other money market instruments, such as treasury bills or commercial paper, to attract investors.

-

Role in Valuation and Pricing

The interest rate is a critical input in the valuation models used to determine the fair market value of these instruments. Present value calculations, discounting future interest payments and the principal amount, are essential for pricing them in the secondary market. Changes in market interest rates will affect the present value of these instruments, causing their prices to fluctuate. For example, if market interest rates rise, the present value of existing instruments with lower fixed interest rates will decrease, leading to a decline in their market price. The accurate assessment of interest rate risk is therefore crucial for investors trading these instruments.

-

Influence on Secondary Market Activity

The differential between the instrument’s coupon rate (the stated interest rate) and prevailing market interest rates affects activity in the secondary market. If the coupon rate is higher than current market rates, the certificate may trade at a premium. Conversely, if the coupon rate is lower, it may trade at a discount. Investors actively seek to profit from these rate differentials by buying and selling these instruments in the secondary market. The more significant the difference between the coupon rate and market rates, the greater the potential for price fluctuations and trading activity. Sophisticated investors use hedging strategies to mitigate interest rate risk and capitalize on these market movements.

In conclusion, the “interest bearing” characteristic is integral to the definition of negotiable certificates of deposit, shaping their role as an investment vehicle, their valuation in the market, and the behavior of both issuers and investors. The rate paid, and its relationship to prevailing market conditions, is central to the function and assessment of these financial products.

Suggested read: CPT Certification: What It Is & Why It Matters

Frequently Asked Questions

The following addresses common inquiries regarding the defining characteristics and practical applications of the financial instrument.

Question 1: What distinguishes a negotiable certificate of deposit from a standard certificate of deposit?

The primary distinction lies in transferability. A negotiable certificate of deposit can be sold and transferred to another party before its maturity date, while a standard certificate of deposit typically cannot. This transferability establishes a secondary market for negotiable instruments, providing liquidity to investors.

Question 2: Who are the typical purchasers of these instruments?

Due to the large denominations in which they are issued, the instruments are primarily purchased by institutional investors, such as corporations, money market funds, pension funds, and other financial institutions seeking short-term, low-risk investment opportunities.

Question 3: How does the creditworthiness of the issuing bank affect these instruments?

Suggested read: Quick Wget Ignore Certificate: The Simple Fix

The creditworthiness of the issuing bank is a critical factor. A higher credit rating generally leads to lower yields, reflecting the reduced risk of default. Conversely, lower-rated banks must offer higher yields to compensate investors for the increased risk. The market price in the secondary market will also be influenced by the bank’s credit rating.

Question 4: Are these instruments insured, and if so, to what extent?

In many jurisdictions, the instruments issued by insured banks are covered by deposit insurance, up to specified limits. However, it is crucial to understand the specific insurance coverage limits within a given jurisdiction, as coverage may not extend to the full value of large-denomination instruments.

Question 5: How does the fixed maturity of a negotiable certificate of deposit influence investment strategies?

The fixed maturity allows investors to align these investments with specific short-term cash flow needs or liability management objectives. Investors select maturity dates that coincide with anticipated funding requirements, ensuring that funds are available when needed. The length of the maturity period impacts the yield offered, with longer maturities typically commanding higher yields to compensate for increased interest rate risk.

Question 6: What factors contribute to price fluctuations in the secondary market?

Suggested read: Get Wetland Delineation Certification: Your Path

Price fluctuations in the secondary market are driven by a combination of factors, including changes in prevailing interest rates, shifts in the perceived creditworthiness of the issuing bank, and supply and demand dynamics. When interest rates rise, the value of existing instruments with lower fixed interest rates tends to decline, and vice versa.

Understanding the transferability, institutional focus, issuer creditworthiness, insurance limitations, fixed maturity implications, and market dynamics are essential for effectively utilizing the financial instrument.

The subsequent sections will further explore the regulatory environment and practical considerations associated with investing in these instruments.

Navigating the Market

Effective utilization of negotiable certificates of deposit demands careful consideration of various factors. Diligence in understanding both the instrument’s characteristics and market conditions is paramount for maximizing returns and mitigating potential risks.

Tip 1: Assess Issuer Creditworthiness Rigorously: Before investing, conduct thorough due diligence on the issuing bank. Examine credit ratings from multiple agencies and analyze financial statements to evaluate the bank’s financial health. Invest in instruments issued by highly-rated institutions to minimize the risk of default. A downgrade in an issuer’s credit rating can significantly reduce the value of the certificate in the secondary market.

Tip 2: Compare Yields Across Maturities: Analyze the yield curve for these instruments, comparing rates across different maturity periods. Understand the relationship between maturity and yield and choose instruments that align with investment goals and risk tolerance. Avoid simply chasing the highest yield; consider the risk associated with longer maturities. For example, in an environment where interest rates are expected to rise, a shorter-term instrument may be more advantageous.

Tip 3: Monitor Secondary Market Liquidity: Evaluate the liquidity of the secondary market for the specific instrument under consideration. A highly liquid market ensures that the instrument can be readily bought or sold if necessary. Check the trading volume and bid-ask spreads to assess market liquidity. Wider spreads and low trading volumes indicate lower liquidity, which can make it difficult to sell the instrument quickly at a favorable price.

Suggested read: Free Volunteer Certificate: Get Yours Now!

Tip 4: Diversify Holdings: Do not concentrate investments solely in these instruments from a single issuer. Diversify across multiple banks to mitigate the risk of a single institution’s financial distress impacting the portfolio. Allocation strategies should be based on the size of the portfolio and institutional constraints.

Tip 5: Understand Call Provisions: Determine if the certificate has any call provisions that allow the issuing bank to redeem the instrument before its stated maturity date. Call provisions can negatively impact returns if the instrument is redeemed when interest rates have fallen. Understand the terms of any call provision before investing.

Tip 6: Consider Tax Implications: Be aware of the tax implications associated with these instruments. Interest income is generally taxable as ordinary income. Tax-exempt investors should factor in the implications.

Tip 7: Leverage Professional Advice: Seek guidance from experienced financial advisors, particularly when dealing with large-denomination certificates of deposit. Professional expertise can help in navigating the complexities of the market and developing an effective investment strategy.

Effective management requires careful evaluation of issuer risk, market conditions, maturity dates, and potential call provisions, combined with prudent diversification. Professional financial advisory should be sought to develop optimum strategies.

The final section will summarize the essential insights discussed in this document, emphasizing the instrument’s significance in the broader financial landscape.

In Summary

The preceding analysis explored the defining characteristics of the negotiable certificate of deposit, highlighting its transferability, issuance by banks, typical large denominations, presence in a secondary market, fixed maturity and interest-bearing status. Understanding these features is paramount for effective utilization of this financial instrument, particularly with respect to risk management and strategic asset allocation.

Prudent employment of negotiable certificates of deposit necessitates due diligence regarding issuer creditworthiness and the monitoring of market conditions. The continued evolution of financial markets warrants ongoing vigilance in assessing the role and potential of this instrument within diversified investment portfolios. Further research into the effects of monetary policy on this financial instrument is needed to determine its efficacy.